From Reuters:

Which also means that if the continued Spanish government cash decline persisted into August after plunging from March to July (as we reported before), then at this point not even a long-overdue bailout request by Rajoy will do anything more than push up Spanish bonds for a week or two before the Spanish house of cards finally comes tumbling down.Consumers and firms continued to pull their money out of Spanish banks in August but at a slower speed than in July, with private sector deposits falling slightly more than 1 percent as Spain was sucked into the centre of the euro zone debt crisis.

Private-sector deposits at Spanish banks fell to 1.492 trillion euros at end-August from 1.509 trillion euros in the previous month, hitting their lowest point since April 2008.

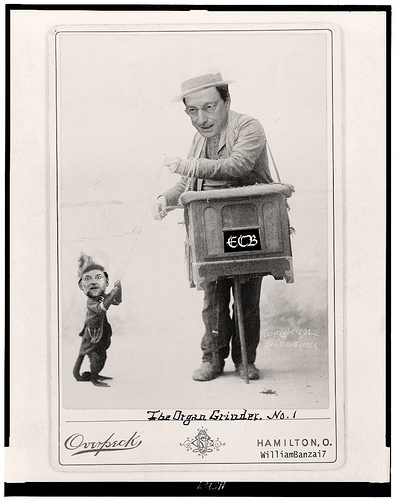

But back to Spain's deposits, or lack thereof, in today's scary chart of the day:

Naturally, the above chart means that with the ECB needed to step in Spanish banks, the entire country has already been effectively bailed out.

And a detailed breakdown:

Today, however, it is not Spanish banks that will dominate the newsflow, but the resumption of Spanish riots as Rajoy announces shortly the details of his plan to promote futher austerity, even as more and more insolvent regions demand that the insolvent government bail them out. From the FT:

As protesters descended on Spain’s parliament for a second night on Wednesday, Mr Rajoy called on Spaniards to ignore “short-term interests”. His government is also preparing to unveil a new reform programme and the results of a banking stress test.

There was more trouble for Mr Rajoy in the regions when Castilla La Mancha, run by his centre-right Popular party, requested a €800m bailout from the central government. Castilla La Mancha is the fifth of Spain’s heavily indebted regional administrations to request financial assistance from Madrid.

The political turmoil continued to put pressure on Spanish stocks, with the Ibex share index falling 0.6 per cent on Thursday morning. On Wednesday, events in Spain triggered a sell-off of European shares as investor concerns mounted about the eurozone’s fourth-largest economy.

The financial pressures on Mr Rajoy’s government have been intensified by a constitutional crisis brewing over the Catalonia region, which called snap elections this week that could hasten a move toward independence.

“Spain is increasingly slipping from his hands,” said Alfredo Pérez Rubalcaba, the leader of the country’s opposition socialist party. “There are very clear fractures in Spain, and the one I am most worried about is social fracture.”

Source

banzai7

No comments:

Post a Comment