Authored by Ben Hunt: There’s a wonderful scene in Stanley Kubrick’s 1964 masterpiece, Dr. Strangelove or: How I Learned to Stop Worrying and Love the Bomb, where the assorted generals and politicians in the War Room are wrestling with the reality their policies have created – mutually assured destruction gone awry, where now everyone will be assuredly destroyed.

Dr. Strangelove pipes up to describe a theory of survival in the face of such a depressing reality, where the most genetically fit humans (along with their political and military leaders, of course) go underground into a giant mine shaft to wait out the apocalypse and then repopulate the Earth.

This is the power of theory in the service of political expediency, the power of post hoc rationalizations gussied up as “theory”.

“Theory” makes us feel better about all the bad stuff we’ve done.

Want more examples? I’ve got hundreds. For every politically expedient or power-expanding action that any government has ever done in the history of the world, there was a post hoc “theory” that supported it. Laffer Curves, anyone?

Modern Monetary Theory – which is neither modern nor a theory – is a post hoc rationalization of political expediency and power-expanding action.

It makes us feel better about all the bad stuff we’ve done with money and debt for the political efficacy of Team Elite.

And all the bad stuff we’re going to do.

At its core, Modern Monetary Theory is an argument that would be wonderfully familiar to every sovereign since the invention of debt. It is essentially the argument that significant sovereign debt is a good thing, not a bad thing, and that budget balancing efforts on a national scale do much more harm than good. Why? Because there’s so much to do and so little time for the right-minded sovereign. Because it is fundamentally unjust for the demands of private lenders to thwart the necessary ends of the sovereign, and it is politically difficult to finance those ends through tax levies on a fickle citizenry.

MMT is the sovereign-friendly justification for deficit spending without end.

Historically, this argument has been used by sovereigns to support wars without end.

Here, for example, is Edward III (1312 – 1377), shown below on the left in effigy at Westminster and on the right counting the dead at the battle of Crecy, the first major English victory in the Hundred Years War. And you thought Afghanistan was dragging on and on.

Edward III borrowed vast sums from Italian banks to finance his campaign. When he defaulted on those loans, the Italian banks were ruined. But Edward was fine, thank you very much. And within a hundred years or so, Edward’s successors were getting loans from other Italian banks. That’s the core logic of MMT. A sovereign’s gotta do what a sovereign’s gotta do, and private capital just has to deal with it.

What’s modern about MMT is this: the modern sovereign’s balance sheet cannot be understood solely from a fiscal perspective. The sovereign’s balance sheet includes not only the assets and liabilities of the sovereign’s treasury from tax-and-spend-and-borrow fiscal policy, but also the assets and liabilities of the sovereign’s central bank from money-printing-and-pricing monetary policy. As a result, MMT holds that not only are austerity and budget-balancing policies a bad move, but so are balance sheet-reducing and liquidity-draining policies. MMT is the theoretical justification for QE without end.

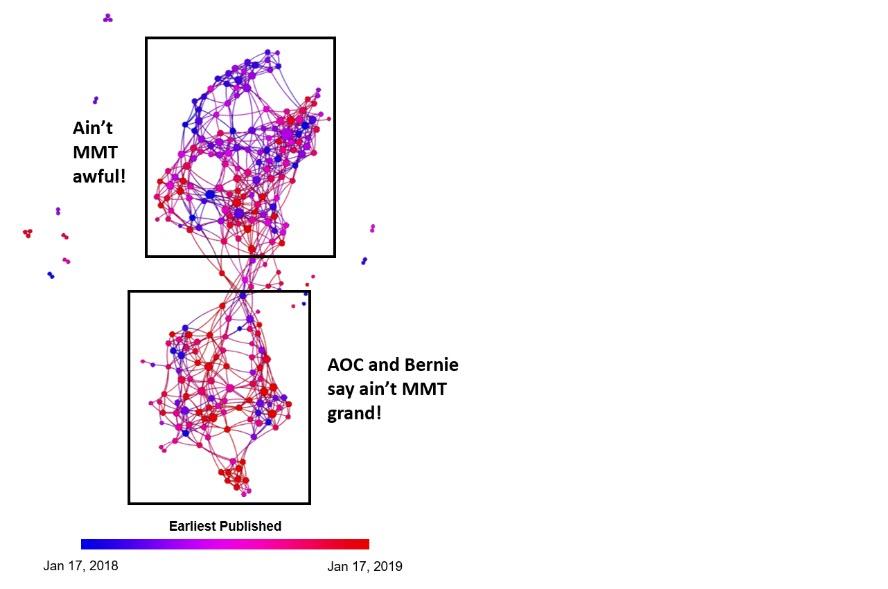

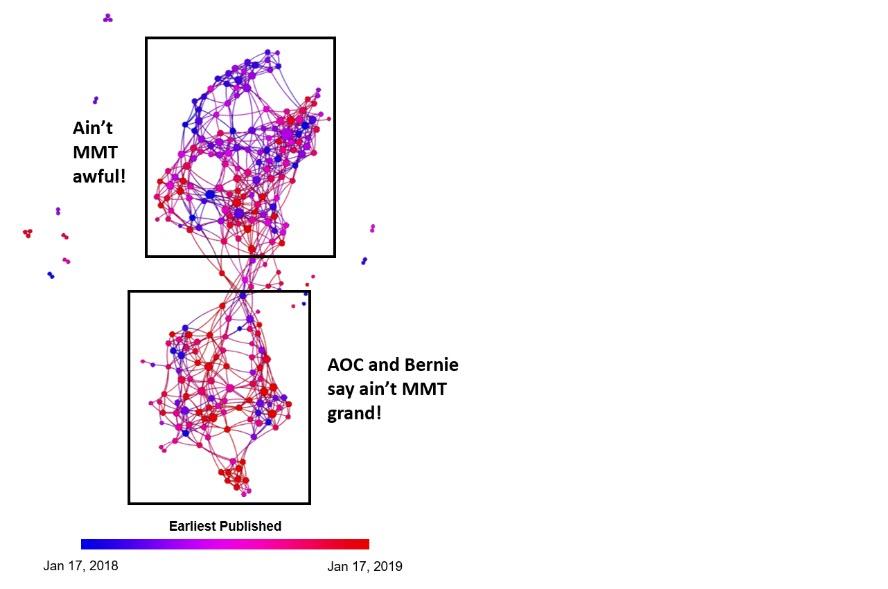

You may not have heard about MMT yet. It’s still a nascent narrative. But it’s growing, and it’s growing fast. Here’s a map of all non-paywalled US media articles on MMT over the past year, colored by recency (blue older and red more recent). Only 272 unique articles over this span (although 3x from the prior year), but you can see where this is going. Twelve months ago this was a fringe issue, negatively portrayed in the press. Today it’s part of the AOC media machine, with Bernie there to cheer it on.

Source: NLP analytics courtesy of Quid

Like I said, you may not have heard about MMT yet. But you will. You won’t be able to avoid it.

Why? Because MMT is the post hoc justification of both easy fiscal policy and easy monetary policy. As such, it is the new intellectual darling of every political and market Missionary of the Left AND the Right.

MMT is the theoretical justification for the economic policies of Trump and his Wall Street fellow travelers alike, who want nothing more than to keep the market punchbowl in place and well-spiked with pure grain ZIRP alcohol forever and ever, amen.

MMT is the theoretical justification for the economic policies of every potential Democratic presidential candidate in 2020. Because with MMT, you CAN have it all. You can pay for wars without end. You can pay for universal single-payer healthcare. You can pay for everyone to go to college. You can pay for a universal basic income. I mean … why not? A caring sovereign’s gotta do what a caring sovereign’s gotta do.

So yeah, you’re going to hear a lot more about Modern Monetary Theory. And you’re almost certainly going to get it.

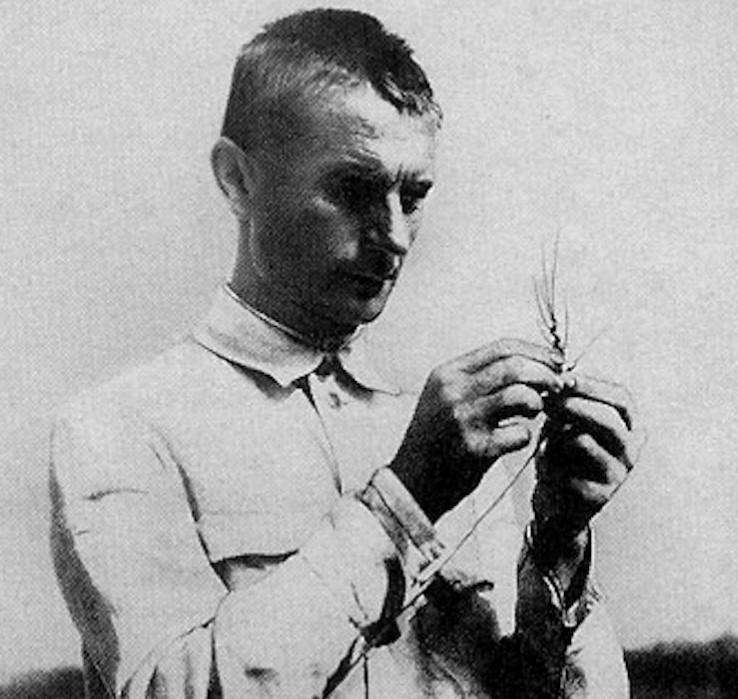

Modern Monetary Theory is to the 21st-century United States what Lysenko Genetics Theory was to the 20th-century Soviet Union.

Everyone in a position of political power wanted to believe Lysenko’s “theories” of acquired inheritance and seed plantings SO MUCH, because it would make all of these horrible collectivist farming policies work out okay.

And then the famines began.

Look, I’m not a gold standard wacko or a balanced budget loon. I fully understand that the debt of all of us is a completely different animal than the debt of any of us. I’ve got a social science Ph.D. from the Team Elitist of Team Elite institutions. I was an ordained priest a tenured professor in this Church scientific field.

I get the joke.

So don’t tell me that the crowding-out effect of sovereign debt on the real economy isn’t a bad thing. Because it is. This is how entire economies are turned into zombies.

Don’t tell me that the monetization of sovereign debt, explicitly or implicitly, isn’t a bad thing. Because it is. This is how a middle class is destroyed.

Sigh.

I can see this narrative storm system forming off the coast of Africa. I can see it heading west across the Atlantic. I know the warm waters of the election cycle Gulf are going to feed it until it becomes a monster. I know it’s going to make landfall.

I can’t stop it and you can’t stop it. But forewarned is forearmed.

We can prepare for the storm.

Source

Dr. Strangelove pipes up to describe a theory of survival in the face of such a depressing reality, where the most genetically fit humans (along with their political and military leaders, of course) go underground into a giant mine shaft to wait out the apocalypse and then repopulate the Earth.

General “Buck” Turgidson: Doctor, you mentioned the ratio of ten women to each man. Now, wouldn’t that necessitate the abandonment of the so-called monogamous sexual relationship, I mean, as far as men were concerned?Nothing like a good porn fantasy to change the reality of nuclear annihilation from fear and loathing to “actually, doomsday machines can be fun and rewarding”. Yes, mistakes were made, but when all is said and done the world will be a better place for our having blown it up. Don’t you feel better already?

Dr. Strangelove: Regrettably, yes. But it is, you know, a sacrifice required for the future of the human race.

I hasten to add that since each man will be required to do prodigious… service along these lines, the women will have to be selected for their sexual characteristics which will have to be of a highly stimulating nature.

Ambassador de Sadesky: I must confess, you have an astonishingly good idea there, Doctor.

This is the power of theory in the service of political expediency, the power of post hoc rationalizations gussied up as “theory”.

“Theory” makes us feel better about all the bad stuff we’ve done.

Want more examples? I’ve got hundreds. For every politically expedient or power-expanding action that any government has ever done in the history of the world, there was a post hoc “theory” that supported it. Laffer Curves, anyone?

Modern Monetary Theory – which is neither modern nor a theory – is a post hoc rationalization of political expediency and power-expanding action.

It makes us feel better about all the bad stuff we’ve done with money and debt for the political efficacy of Team Elite.

And all the bad stuff we’re going to do.

At its core, Modern Monetary Theory is an argument that would be wonderfully familiar to every sovereign since the invention of debt. It is essentially the argument that significant sovereign debt is a good thing, not a bad thing, and that budget balancing efforts on a national scale do much more harm than good. Why? Because there’s so much to do and so little time for the right-minded sovereign. Because it is fundamentally unjust for the demands of private lenders to thwart the necessary ends of the sovereign, and it is politically difficult to finance those ends through tax levies on a fickle citizenry.

MMT is the sovereign-friendly justification for deficit spending without end.

Historically, this argument has been used by sovereigns to support wars without end.

Here, for example, is Edward III (1312 – 1377), shown below on the left in effigy at Westminster and on the right counting the dead at the battle of Crecy, the first major English victory in the Hundred Years War. And you thought Afghanistan was dragging on and on.

Edward III borrowed vast sums from Italian banks to finance his campaign. When he defaulted on those loans, the Italian banks were ruined. But Edward was fine, thank you very much. And within a hundred years or so, Edward’s successors were getting loans from other Italian banks. That’s the core logic of MMT. A sovereign’s gotta do what a sovereign’s gotta do, and private capital just has to deal with it.

What’s modern about MMT is this: the modern sovereign’s balance sheet cannot be understood solely from a fiscal perspective. The sovereign’s balance sheet includes not only the assets and liabilities of the sovereign’s treasury from tax-and-spend-and-borrow fiscal policy, but also the assets and liabilities of the sovereign’s central bank from money-printing-and-pricing monetary policy. As a result, MMT holds that not only are austerity and budget-balancing policies a bad move, but so are balance sheet-reducing and liquidity-draining policies. MMT is the theoretical justification for QE without end.

You may not have heard about MMT yet. It’s still a nascent narrative. But it’s growing, and it’s growing fast. Here’s a map of all non-paywalled US media articles on MMT over the past year, colored by recency (blue older and red more recent). Only 272 unique articles over this span (although 3x from the prior year), but you can see where this is going. Twelve months ago this was a fringe issue, negatively portrayed in the press. Today it’s part of the AOC media machine, with Bernie there to cheer it on.

Source: NLP analytics courtesy of Quid

Like I said, you may not have heard about MMT yet. But you will. You won’t be able to avoid it.

Why? Because MMT is the post hoc justification of both easy fiscal policy and easy monetary policy. As such, it is the new intellectual darling of every political and market Missionary of the Left AND the Right.

MMT is the theoretical justification for the economic policies of Trump and his Wall Street fellow travelers alike, who want nothing more than to keep the market punchbowl in place and well-spiked with pure grain ZIRP alcohol forever and ever, amen.

MMT is the theoretical justification for the economic policies of every potential Democratic presidential candidate in 2020. Because with MMT, you CAN have it all. You can pay for wars without end. You can pay for universal single-payer healthcare. You can pay for everyone to go to college. You can pay for a universal basic income. I mean … why not? A caring sovereign’s gotta do what a caring sovereign’s gotta do.

So yeah, you’re going to hear a lot more about Modern Monetary Theory. And you’re almost certainly going to get it.

Modern Monetary Theory is to the 21st-century United States what Lysenko Genetics Theory was to the 20th-century Soviet Union.

Everyone in a position of political power wanted to believe Lysenko’s “theories” of acquired inheritance and seed plantings SO MUCH, because it would make all of these horrible collectivist farming policies work out okay.

And then the famines began.

Look, I’m not a gold standard wacko or a balanced budget loon. I fully understand that the debt of all of us is a completely different animal than the debt of any of us. I’ve got a social science Ph.D. from the Team Elitist of Team Elite institutions. I was an ordained priest a tenured professor in this Church scientific field.

I get the joke.

So don’t tell me that the crowding-out effect of sovereign debt on the real economy isn’t a bad thing. Because it is. This is how entire economies are turned into zombies.

Don’t tell me that the monetization of sovereign debt, explicitly or implicitly, isn’t a bad thing. Because it is. This is how a middle class is destroyed.

Sigh.

I can see this narrative storm system forming off the coast of Africa. I can see it heading west across the Atlantic. I know the warm waters of the election cycle Gulf are going to feed it until it becomes a monster. I know it’s going to make landfall.

I can’t stop it and you can’t stop it. But forewarned is forearmed.

We can prepare for the storm.

Source

No comments:

Post a Comment