Disgruntled Western electors are beginning to view foreign entanglements in a similar way to Neville Chamberlain in 1938: “a quarrel in a faraway land between people of which we know nothing.”

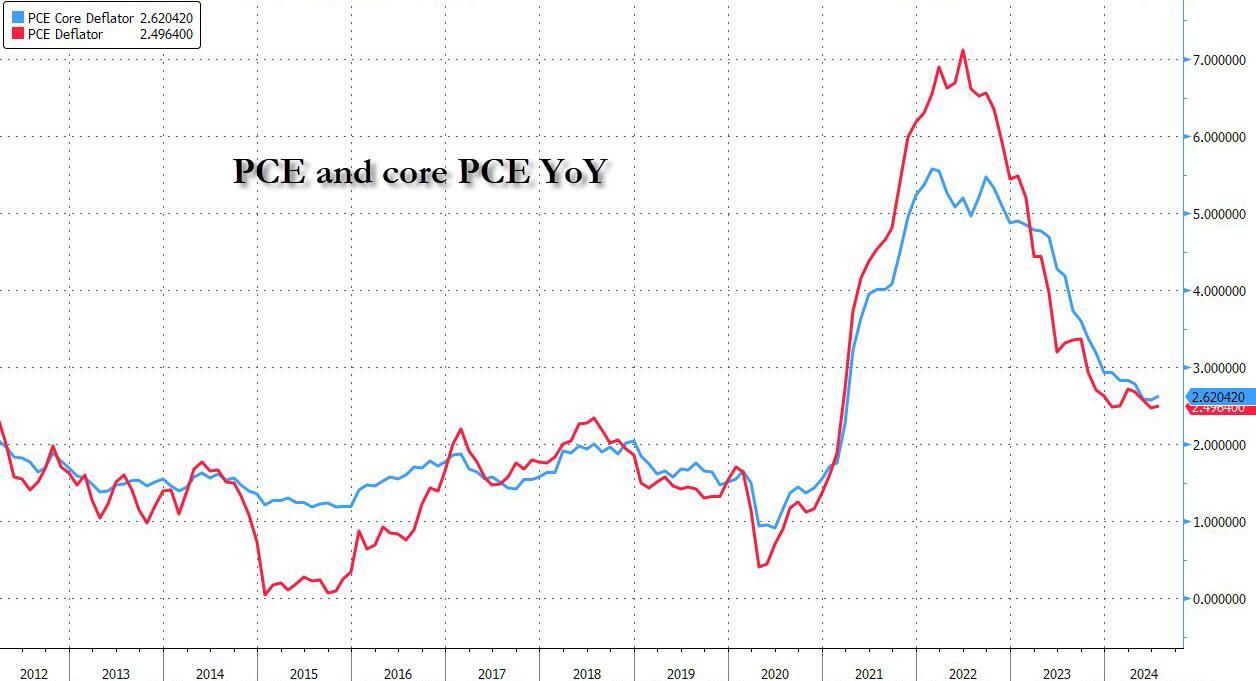

By Benjamin Picton: US Core PCE figures reported on Friday showed that inflation slowed a little more than expected in the year to July. Year-on-year price growth was 2.6% versus a consensus estimate of 2.7%, while the month-on-month figure printed in line with expectations at +0.2%.

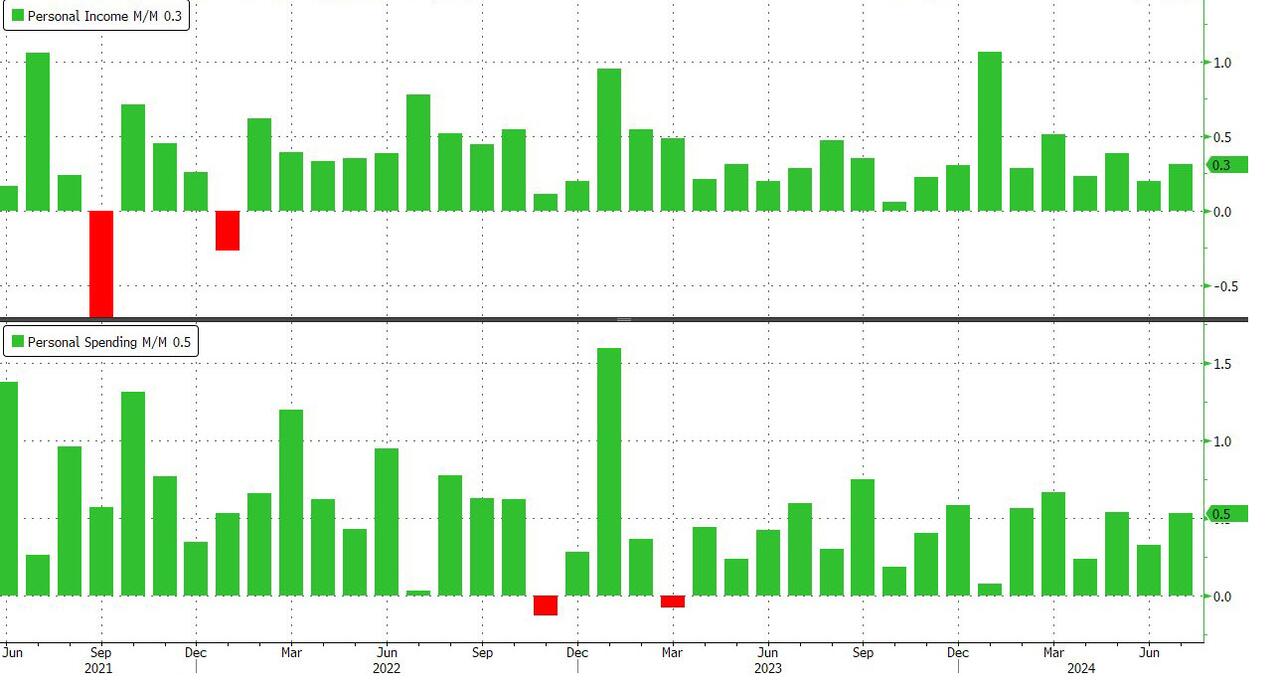

While inflation appears headed in the right direction, household finances may not be. Personal income rose a better-than-expected 0.3% in July, but was eclipsed by a 0.5% lift in personal spending. We have to go all the way back to January to find a month where personal incomes grew at a faster pace than expenditures.

My colleague Bas van Geffen noted on Friday that the recent upward revision in quarterly GDP growth to 3% is unlikely to be repeated in the months ahead as evidence mounts that consumers are feeling the pinch. While spending growth outstrips income growth we have seen a steady uptrend in average credit card balances and delinquency rates. Surely not a sustainable trajectory.