'The bank which only a decade ago dominated equity and fixed income and sales trading and investment banking across the globe, and was Europe's banking behemoth, is no more.'

DB Exits Equities In $8.4 Billion Overhaul, To Fire Thousands

By Tyler Durden: The bank which only a decade ago dominated equity and fixed income and sales trading and investment banking across the globe, and was Europe's banking behemoth, is no more.

By Tyler Durden: The bank which only a decade ago dominated equity and fixed income and sales trading and investment banking across the globe, and was Europe's banking behemoth, is no more.On Sunday afternoon, in a widely telegraphed move, Deutsche Bank announced that it was exiting its equity sales and trading operation, resizing its once legendary Fixed Income and Rates operations and reducing risk-weighted assets currently allocated to these business by 40%, slashing as many as 20,000 jobs including many top officials, and creating a €74 billion "bad bank" as part of a reorganization which will cost up to €7.4 billion by the end of 2022 and which will result in another massive Q2 loss of €2.8 billion, as the bank hopes to slash costs by €17 billion in 2022, while ending dividends for 2019 and 2020 even as it hopes to achieve all this without new outside capital.

"Today we have announced the most fundamental transformation of Deutsche Bank in decades. We are tackling what is necessary to unleash our true potential: our business model, costs, capital and the management team. We are building on our strengths. This is a restart for Deutsche Bank – for the long-term benefit of our clients, employees, investors and society", CEO Christian Sewing said in a statement.

“In refocusing the bank around our clients, we are returning to our roots and to what once made us one of the leading banks in the world. We remain committed to our global network and will help companies to grow and provide private and institutional clients with the best solutions and advice for their respective needs – in Germany, Europe and around the globe. We are determined to generate long-term, sustainable returns for shareholders and restore the reputation of Deutsche Bank.”In what has been dubbed a "radical overhaul", the biggest German lender, unveiled one of the most comprehensive banking restructurings since the financial crisis, closing most of its trading unit and splitting off €74bn of its assets as the struggling German lender calls time on its "20-year attempt to break into the top ranks of Wall Street." "These actions are designed to allow Deutsche Bank to focus on and invest in its core, market leading businesses of Corporate Banking, Financing, Foreign Exchange, Origination & Advisory, Private Banking, and Asset Management" the bank said in a Sunday statement.

The highlights of the "radical transformation" as published by the bank:

- Creating a fourth business division called the Corporate Bank which will be comprised of the Global Transaction Bank and the German commercial banking business.

- Exiting the Equities Sales & Trading business and reducing the amount of capital used by the Fixed-Income Sales & Trading business, in particular Rates.

- Returning 5 billion euros of capital to shareholders starting in 2022, facilitated by a new Capital Release Unit (CRU) to which the bank plans initially to transfer approximately 288 billion euros, or about 20% of Deutsche Bank’s leverage exposure, and 74 billion euros of risk weighted assets (RWA) for wind-down or disposal.

- Funding the transformation through existing resources including maintaining a minimum Common Equity Tier 1 ratio of 12.5%. The bank expects to execute its restructuring without the need to raise additional capital.

- As a result, the bank’s leverage ratio is expected increase to 4.5% in 2020 and approximately 5% from 2022.

- Reducing adjusted costs by 2022 by approximately 6 billion euros to 17 billion euros, a reduction by a quarter of the current cost base.

- Targeting a Return on Tangible Equity of 8% by 2022.

- Investing 13 billion euros in technology by 2022, to drive efficiency and further improve products and services.

And the key aspects of the reorganization, in more detail as published in a company press release, include:

The exit of Global Equities and a significant reduction in Corporate and Investment Banking risk weighted assets

Deutsche Bank will exit its Equities Sales & Trading business, while retaining a focused equity capital markets operation. In addition, the bank plans to resize its Fixed Income operations in particular its Rates business and will accelerate the wind-down of its existing non-strategic portfolio. In aggregate, Deutsche Bank will reduce risk-weighted assets currently allocated to these businesses by approximately 40%.A significant restructuring of businesses and infrastructure

The bank will create a new Capital Release Unit to manage the efficient wind-down of the assets related to business activities, which are being exited or reduced. These assets and businesses represented EUR 74 billion of risk-weighted assets and EUR 288 billion of leverage exposure, as of 31 December 2018.

Deutsche Bank will implement a cost reduction program designed to reduce adjusted costs to EUR 17 billion in 2022 and is targeting a cost income ratio of 70% in that year.Managing the transformation through existing resources

To facilitate its restructuring, Deutsche Bank expects to take approximately EUR 3 billion of aggregate charges in the second quarter of 2019, of which approximately EUR 0.2 billion would impact Common Equity Tier 1 capital. These charges include a Deferred Tax Asset write-down of approximately EUR 2 billion and impairments of approximately EUR 0.9 billion. Additional restructuring charges are expected in the second half of 2019 and subsequent years. In aggregate, Deutsche Bank currently expects cumulative charges of EUR 7.4 billion by the end of 2022.

Deutsche Bank management intends to fund its transformation from its existing resources without requiring additional capital. This reflects the bank’s current strong capital position as well as management’s confidence in the high quality and low risk nature of the assets, which it is exiting. In connection with these decisions, the Management Board intends to recommend no common equity dividend be paid for the financial years 2019 and 2020. The bank expects to have capacity for payments on additional tier 1 securities throughout the transformation phase.Updated capital and leverage targets

The Management Board believes that the future business mix is consistent with a lower capital requirement. After consultation with the bank’s regulators, the bank now intends to operate with a minimum CET1 ratio of 12.5% going forward. As a result of the significant deleveraging actions, the bank targets a fully-loaded leverage ratio of 4.5% by the end of 2020 rising to approximately 5% by 2022.Improving broken internal controls

Deutsche Bank is committed to investing a further 4 billion euros in improving controls by 2022. The bank will combine its Risk, Compliance and Anti-Financial Crime functions to strengthen processes and controls while also increasing efficiency. To reshape and improve its long-term competitive position, the bank will undertake a restructuring of its infrastructure functions, which include back office systems and processes that support all business divisions. These functions will become leaner, more innovative and more digital.Of course, none of the above will come for free, and the bank will incur second quarter charges related to the restructuring described above, resulting in a pretax loss before income taxes of approximately EUR 500 million and a net loss of EUR 2.8 billion. The silver lining - if one excludes all these "one-time" charges - which is ironic for the bank which has been restructuring every quarter for the past few years - Deutsche Bank expects to report second quarter 2019 income before income taxes of approximately EUR 400 million and net profit of EUR 120 million.

A separate Technology function will be created which will have responsibility to further optimize Deutsche Bank’s IT infrastructure. It will also drive the digitalisation of all businesses. This is set to boost innovation as well as further strengthen the internal control environment. The bank will make targeted investments in technology and innovation, utilising a budget of 13 billion euros by 2022.

As the FT notes, the new strategy by CEO Christian Sewing "signals a retreat from Deutsche’s global ambitions and its aim to be Europe’s main rival to Goldman Sachs". Instead, one year ahead of Deutsche’s 150th anniversary, Sewing is refocusing the lender on its historic roots — financing German and European corporate clients and domestic retail banking.

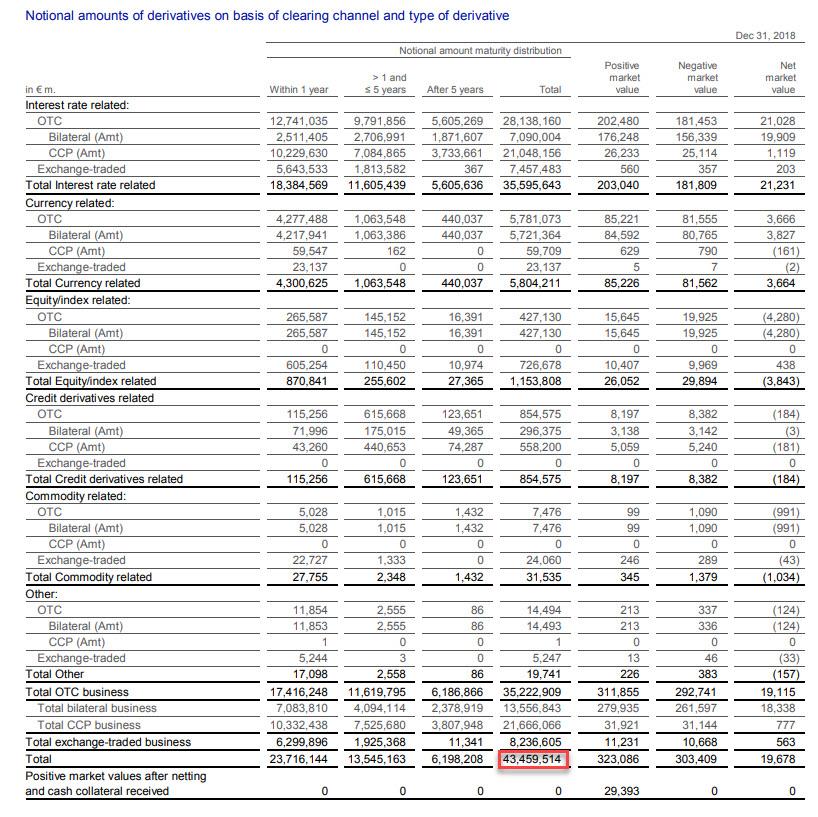

As we noted previously, the bank with the €43.5 trillion in gross derivatives notional...

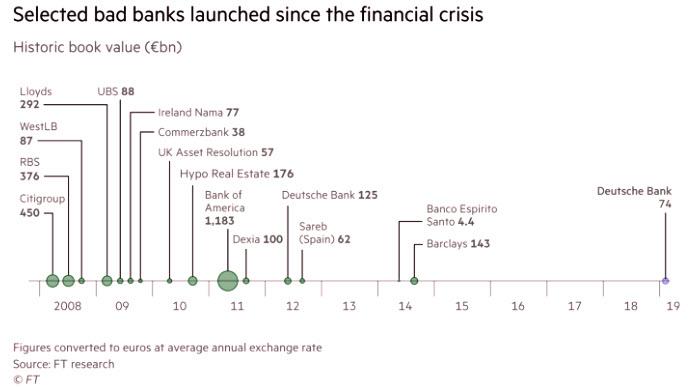

... will be hard-pressed to ringfence all of its toxic assets in a relatively modest €74 billion silo. What is just as notable is that the use of a bad bank, an artificial crutch that was prevalent during the financial crisis and shortly after as shown in the chart below...

... confirms that many if not most of Europe's banks are just as challenged as they were a decade ago, and only the ECB's actions prevented the market from grasping the true severity of the situation. Which, in a sense, is paradoxical because it is the ECB's NIRP/QE policies that made Deutsche Bank's historic restructuring inevitable.

Finally, the bank also said that the restructuring actions will include a workforce reduction of approximately 18,000 full-time equivalent employees to around 74,000 employees by 2022. In aggregate, the bank expects to reduce adjusted costs by approximately 6 billion euros to 17 billion euros in 2022, although pink slip details are likely reserved for a more intimate context.

Most of the job losses are set to come at the investment bank, particularly the underperforming operations on Wall Street and in the City of London. Not only the rank and file will be affected: as we reported yesterday, two top executives have already departed as part of the overhaul — Garth Ritchie, investment banking chief, and Frank Strauss, head of retail banking. Sylvie Matherat, chief regulatory officer, is also expected to leave, as are the bank's debt chiefs Yanni Pipilis and James Davies.

While it is unclear if the bank can achieve its ambitious agenda in the next 3 years, one thing is certain - the Deutsche Bank that saw RenTec close out its counterparty exposure in recent weeks anticipating what was coming - is no more, and it remains to be seen if the "successor" will be any more successful.

Source

No comments:

Post a Comment