By Tyler Durden: It's no secret that BofA's Chief Investment Officer has been warning that 2021 - the year of the vaccine - is one where real inflation (as opposed to financial) will run amok sooner or later, and in his latest Flow Show he repeats his two main contentions about how events will play out in the coming months, namely "the velocity of people will rise" and "the velocity of money will (also) rise".

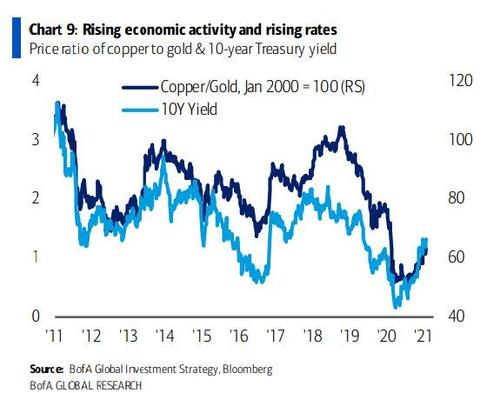

Addressing the first, Hartnett writes that since the core 2021 trends will be "vaccine>virus", and "reopening>lockdown", this means that human mobility will rise & macro data will surge particularly in Q2 when investors should expect US GDP >10%, EPS >20% CPI 3-4% Y/Y, or an economy in fullblown overhating mode.

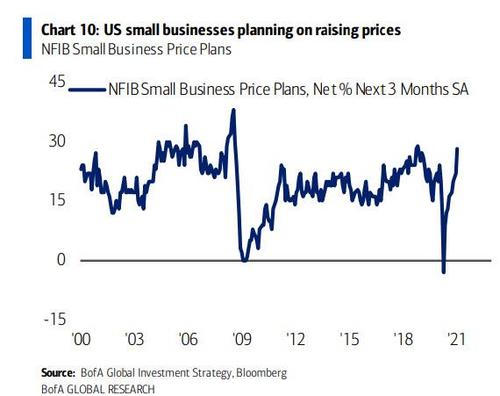

This taken in conjunction with secular trends of bigger government, economic nationalism, fiscal excess, dollar debasement, War on Inequality, there is little wonder inflation breakevens & lead indicators are surging...... and that small US business price plans over next 3 months are at highest since Nov’18...

... although whether or not they can actually achieve this is a different matter.

Stepping into the realm of monetary policy, and specifically its velocity, BofA reminds us that in the past 12 months, the US has raked in a $3.5TN (17% GDP) budget deficit, coupled with the injection of $13.3TN in global central bank liquidity (15% GDP).

Then, unafraid anymore to step on anyone's toes, Hartnett admits that "as in pretty much every one of past 12 years, policy stimulus in 2020/21 continues to flow directly to Wall St not Main St, inciting historic wealth inequality via asset bubbles," and to think of the mockery we were subject to (by random idiots) back in 2009 in later years, when we said the Fed's actions would lead to precisely this.

Anyway, Back fo BofA, which expects the "rising velocity of people" (vaccine>virus) in 2021 to engender rise in velocity of money, with the "inflation mutating" from Wall Street to Main Street, resulting in a pop in the nihilistic bubble.

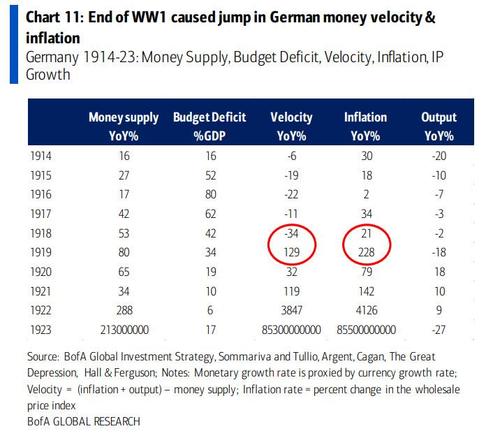

And here is the punchline: BofA reflects back on the post-WW1 Germany (whose armistice was on Nov 1918) as the "most epic, extreme analog of surging velocity and inflation following end of war psychology, pent-up savings, lost confidence in currency & authorities" and specifically the Reichsbank’s monetization of debt, similar of course to what is going on now.

There is, of course, another name for that period: Weimar Germany, and because we all know what happened then, it is understandable why BofA does not want to mention that particular name.

So what does all this mean for investing? Here is how Hartnett is positioned:

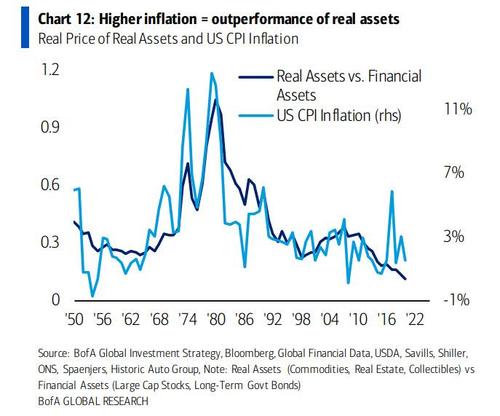

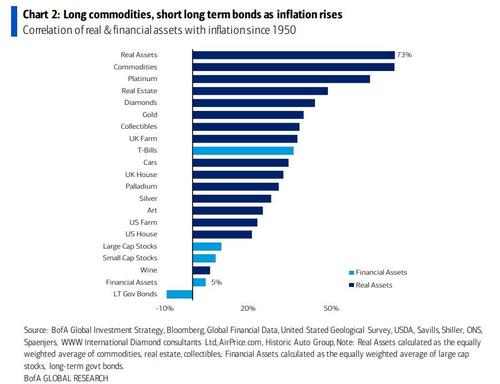

Real assets will outperform financial assets: we believe 2020 marked secular low for rates/inflation, and 2020s likely decade of inflation assets>deflation, and real assets>financial (i.e., buy commodity-linked exposure, sell duration, tech and growth).

And to that point, Hartnett notes that since 1950 real assets (e.g. commodities, real estate, collectibles) have a > 70% correlation with inflation vs. just 5% correlation with financial assets (stocks & bonds).

Translation: Stanley Druckenmiller, and his "thesis trio" of...

- short long-end Treasuries

- very long commodities

- "very very" short the dollar.

... is about to make another killing.

No comments:

Post a Comment