Once inflation cycles start, they gain momentum on their own. That is because price cycles force changes in firms' pricing, ordering, inventory policies, and workers' wage demands.

Today's Inflation Cycle

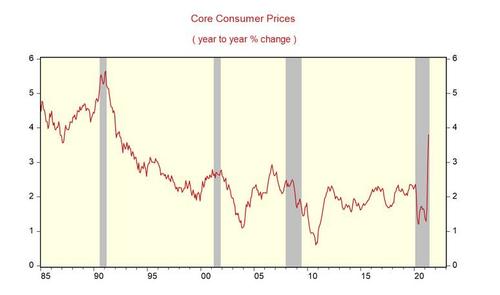

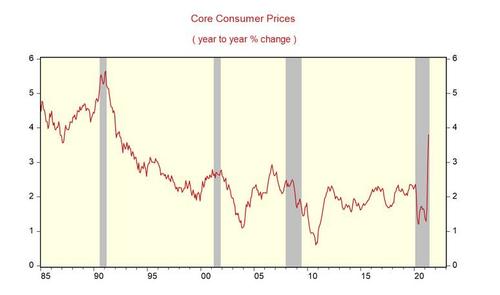

In May, the consumer price index (CPI) rose 0.6%, pushing the twelve-month increase to 5%, the most significant increase since 2008. Core CPI rose 0.7%, lifting the twelve-month increase to 3.8%, the largest increase in almost three decades. As substantial and broad as the gains in reported inflation are, it's essential to the point that experienced inflation is significantly higher.

Over the last several decades, reported inflation has seen substantive measurement changes. For example, government statisticians now employ an arbitrary and non-market price for owner's rent, removing actual housing prices from the calculation. Other substantive changes in the CPI occurred in the mid-1990s following the Congress-sponsored Boskin report, which purportedly shaved 50 to 100 basis points off of reported core CPI each year.

Adjusting reported inflation for those exclusions or changes would result in double-digit gains in both headline and core CPI for the past twelve months. What's worse, knowing consumer prices are running at a double-digit pace, or not knowing actual inflation is that high?

Denying that the current inflation cycle is nothing more than a base effect and is, therefore, "transitory" brings back memories of the 1970s. In the 1970s, Federal Reserve Chair Arthur Burns denied that monetary policy played a role in the inflation cycle. Mr. Burns argued that higher inflation was due to idiosyncratic factors, such as food shortages and the OPEC oil embargo.

The Fed Chair demanded that the Fed staff strip out the volatile food and energy components to prove his point, thereby creating what is now called the core inflation index. That proved to be a policy blunder as it allowed Mr. Burns to maintain an easy money policy that fueled the most significant and most extended inflation cycle in the post-war period.

In recent decades, regional branches of the Federal Reserve have created new price conventions (e.g., median cpi, trimmed cpi). These price measures are misleading as they eliminate the tails in the distribution of prices. And during price cycles, the price tail for items rising a lot is much larger in scale than those at the bottom.

Once inflation cycles start, they gain momentum on their own. That is because price cycles force changes in firms' pricing, ordering, inventory policies, and workers' wage demands.

Significant tightening in monetary policy breaks inflation cycles. It took the Fed Chairs of Volcker and Greenspan an entire decade, lifting official rates far above inflation to break the 1970s inflation, and in 1994 it took Greenspan a full twelve months to suppress a potential cyclical jump in inflation.

Today's inflation cycle creates many problems for the current generation of policymakers.

- First, how can you use justify changing monetary policy for an inflation problem you say doesn't exist?

- Second, if policymakers decide they need to raise real interest rates, what price measure do they use as a benchmark?

- Third, how does the Fed drive real interest rates higher when they own a third of the Treasury market.

Inflation cycles end badly, even when everyone is aware of the problem. Investors are the biggest fans of the "doing nothing" approach of the current generation of policymakers. Yet, if past inflation cycles are a guide to the future, investors will soon become the Fed's loudest critics.

No comments:

Post a Comment