US sanctions are only made to be broken.

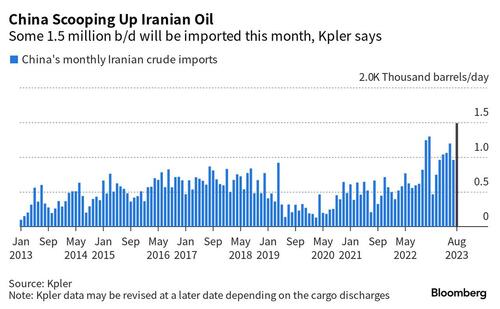

By Tyler Durden: Less than a month ago, we reported that according to Kpler estimates, China was expected to import as much as 1.5 million barrels per day (bpd) of crude oil from Iran in August, the most since at least 2013.

On Thursday, the latest China trade data confirmed just that when customs data revealed that China snapped up Iranian shipments, and state-owned processors ramped up operating rates after a period of maintenance work, in clear breach of US sanctions, soft as they may be, on Iranian oil purchases.

China nation imported 52.8 million tons of crude oil last month, equivalent to 12.5 million barrels a day, 21% more than July, according to Bloomberg calculations. The monthly volume was near a record set in June 2020.

Chinese purchases were driven by a binge on Iranian crude supplies, said Viktor Katona, lead crude analyst with Kpler ahead of data release, as offers from the Persian Gulf producer was “by far the most price-competitive option”. Additionally, imports were also driven by Chinese refiners’ re-stockpiling activity, he added.

Importers were keen to buy discounted barrels from Russia and Iran in order to maximize profit margins from domestic and overseas fuel sales. State refiners were running at record rates in August, according to OilChem. A bumper exports quota issued last week means plants will keep their runs and inflows elevated in support for growth.

Meanwhile, as noted earlier, Chinese oil products exports rose 11% to 5.89 million tons in August, the highest since February, as China aggressively ramped up its refinery output, in the process grabbing market share from Western processors crushed by idiotic, green and "woke" policies and regulations that seek to crush US fossil fuel industries and hand the market to China on a silver platter.

No comments:

Post a Comment