Thanks to the west’s sanctions, Russia is on its way to confirming Halford Mackinder’s predictions made over a century ago, that Russia is the true geopolitical centre of the world...

Authored by Alasdair Macleod: The financial war between Russia with China’s tacit backing on one side, and America and her NATO allies on the other has escalated rapidly. It appears that President Putin was thinking several steps ahead when he launched Russia’s attack on Ukraine.

We have seen sanctions fail.

We have seen Russia achieve record export surpluses. We have seen the rouble become the strongest currency on the foreign exchanges.

We are seeing the west enter a new round of European monetary inflation to pay everyone’s energy bills. The euro, yen, and sterling are already collapsing — the dollar will be next. From Putin’s point of view, so far, so good.

Russia has progressed her power over Asian nations, including populous India and Iran. She has persuaded Middle Eastern oil and gas producers that their future lies with Asian markets, and not Europe. She is subsidising Asia’s industrial revolution with discounted energy. Thanks to the west’s sanctions, Russia is on its way to confirming Halford Mackinder’s predictions made over a century ago, that Russia is the true geopolitical centre of the world.

There is one piece in Putin’s jigsaw yet to be put in place: a new currency system to protect Russia and her allies from an approaching western monetary crisis.

This article argues that under cover of the west’s geopolitical ineptitude, Putin is now assembling a new gold-backed multi-currency system by combining plans for a new Asian trade currency with his new Moscow World Standard for gold.

Currency developments under the radar

Unreported by western media, there are some interesting developments taking place in Asia over the future of currencies. Earlier this summer, it emerged that Sergei Glazyev, a senior Russian economist and Minister in charge of the Eurasian Economic Commission (EAEU), was leading a committee planning a new trade currency for the Eurasian Economic Union.

As put forward in Russian and EAEU media, the new currency is to be comprised of a mixture of national currencies and commodities. A weighting of some sort was suggested to reflect the relative importance of the currencies and commodities traded between them. At the same time, the new trade settlement currency was to be available to any other nation in the Shanghai Cooperation Organisation and the expanding BRICS membership. The ambition is for it to become an Asia-wide replacement for the dollar.

More specifically, the purpose is to do away with the dollar for trade settlements on cross-border transactions between participants. It is worth noting that any dollar transaction is reflected in US banks through the correspondent banking system, potentially giving the US authorities undesirable economic intelligence, and information on sanction-busting and other activities deemed illegal or undesirable by the US authorities. Furthermore, any transaction involving US dollars becomes a matter for the US legal system, giving US politicians the authority to intervene wherever the dollar is used.

As well as removing these disadvantages, through the inclusion of a basket of commodities there appears to be an acceptance that the new trade currency must be more stable in terms of its commodity purchasing power than exists with that of the dollar. But we can immediately detect flaws in the outline proposal. The mooted inclusion of national currencies in the basket is not only an unnecessary complication, but any nation joining it would presumably trigger a wholesale rebalancing of the currency’s composition.

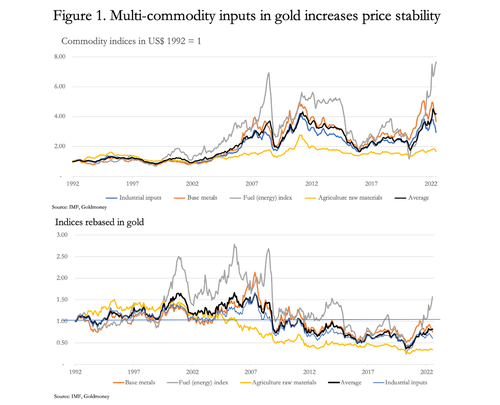

Including national currencies is a preposterous suggestion, as is any suggestion that the commodity element should be weighted by trade volumes transacted between participating states. Instead, an unweighted average of energy, precious metals, and base metals makes more sense, but even that does not go far enough. The reasons are illustrated by the two charts in Figure 1.

The upper chart shows baskets of different categories of commodities indexed and priced in dollars. Between them, they represent a wide range of commodities and raw materials. These baskets are considerably less volatile than their individual components. For example, since April 2020 oil has risen from a distorted minus figure to a high of $130, whereas the energy basket has risen only 6.3 times, because other components have not risen nearly as much as crude oil and some components might be rising while others might be falling. Agriculture raw materials are comprised of cotton, timber, wool, rubber, and hides, not raw materials liable to undesirable seasonality. But the average of the four categories is considerably more stable than its components (the black line).

We are moving towards price stability. However, all commodities are priced in US dollars, which being undesirable, cannot be avoided. Pricing in gold, which is legal money, eventually resolves this problem because it can be fixed against participating currencies. The result of pricing the commodity categories in gold and the average of them is shown in the lower chart.

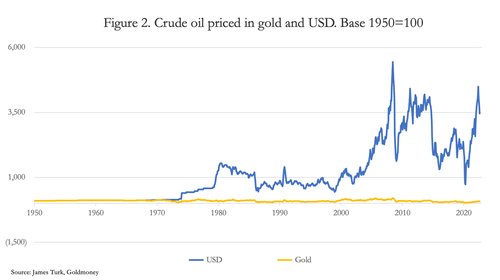

Since 1992, the average (the black line) has varied between 0.37 and 1.66, and is currently at 0.82, or 18% less than in January 1992. This is as stable as it gets, and even this low volatility would probably be less if the dollar wasn’t itself so volatile and the gold price manipulated by nay-saying western authorities. To further illustrate these points, Figure 2 shows the dollar’s volatility in terms of crude oil.

Before the abandonment of Bretton Woods in 1971, the price of oil hardly changed. Since then, measured by gold the dollar has lost 98% of its purchasing power. Furthermore, the chart shows that it is the dollar which is extremely volatile and not oil, because the price of oil in gold is relatively constant (down only 20% from 1950), while in dollars it is up 33.6 times with some wild price swings along the way. Critics of measuring prices in gold ignore the fact that legal money is gold and not paper currencies or bank credit: attempts by governments and their epigones to persuade us otherwise are propaganda only.

Therefore, Glazyev should drop currencies from the proposed basket entirely and strive to either price a basket of non-seasonal commodities in gold, or alternatively simply reference the new currency to gold in a daily fix. And as the charts above confirm, there is little point in using a basket of commodities priced in dollars or gold when it is far simpler for the EAEU nations and for anyone else wishing to participate in the new trade currency to use a trade currency directly tied to the gold price. It would amount to a new Asian version of a Bretton Woods arrangement and would need no further adjustment.

Attributing them to excessive credit, from recent statements by President Putin it is clear he has a better understanding of currencies and the west’s inflationary problems than western economists. Intellectually, he has long demonstrated an appreciation of the relationship between money, that is only gold, and currency and credit. His knowledge was further demonstrated by his insistence that the “unfriendlies” pay for energy in roubles, taking control of the media of energy exchange into Russia’s own hands and away from those of his enemies.

In short, Putin appears to understand that gold is money and that the rest is unreliable, weaponizable, credit. So, why does he not just command a new trade currency to be created, backed by gold?

Enter the new Moscow gold standard

Logic suggests that a gold-backed currency will be the outcome of Glazyev’s EAEU committee’s trade currency deliberations after all, because of a subsequent announcement from Moscow concerning a new Russian bullion market.

In accordance with western sanctions, the London Bullion Market refused to accept Russian mined and processed gold. It was then natural for Russia to propose a new gold market based in Moscow with its own standards. It is equally sensible for Moscow to set up a price fixing committee, replicating that of the LBMA. But instead of it being the basis for a far larger unallocated gold deposit account offering by Russian and other banks, it will be a predominantly physical market.

Based in Moscow, with a new market called the Moscow International Precious Metals Exchange, the Moscow Gold Standard will incorporate some of the LBMA’s features, such as good delivery lists with daily, or twice daily fixings. The new exchange is therefore being promoted as a logical replacement for the LBMA.

But could that be a cover, with the real objective being to provide a gold link to the new trade currency planned by Glazyev’s EAEU committee? Timing suggests that this may indeed be the case, but we will only know for sure as events unfold.

If it is to be backed by gold, the considerations behind setting up a new trade currency are fairly straightforward. There is the Chinese one kilo bar four-nines standard, which is widely owned, has already been adopted throughout Asia, and is traded even on Comex. Given that China is Russia’s long-term partner, that is likely to be the standard unit. The adoption of the Chinese standard in the new Moscow exchange is logical, simplifying the relationship with the Shanghai Gold Exchange, and streamlining fungibility between contracts, arbitrage, and delivery.

Geopolitics suggest that the simple proposition behind the establishment of a new Moscow exchange will fit in with a larger trans-Asia plan and is unlikely to move at the glacial pace of developments between Russia and China to which we have become accustomed. The gold question has become bound up in more rapid developments triggered by Russia’s belligerence over Ukraine, and the sanctions which quickly followed.

There can be little doubt that this must be leading to a seismic shift in gold policy for the Russian Chinese partnership. The Chinese in particular have demonstrated an unhurried patience that befits a nation with a sense of its long history and destiny. Putin is more of a one-man act. Approaching seventy years old, he cannot afford to be so patient and is showing a determination to secure a legacy in his lifetime as a great Russian leader. While China has made the initial running with respect to gold policy, Putin is now pushing the agenda more forcefully.

Before Russia’s invasion of Ukraine, the strategy was to let the west make all the geopolitical and financial mistakes. For Putin perhaps, the lesson of history was informed by Napoleon’s march to the gates of Moscow, his pyrrhic victory at Borodino, and his defeat by the Russian winter. Hitler made the same mistake with Operation Barbarossa. From Putin’s viewpoint, the lesson was clear — Russia’s enemies defeat themselves. It was repeated in Afghanistan, where the American-led NATO enemy was conquered by its own hubris without Putin having to lift so much as a finger. That is why Russia is Mackinder’s Pivot Area of the World Island. It cannot be attacked by navies, and supply line requirements for armies make Russia’s defeat well-nigh impossible

Following the Ukraine invasion, Putin’s financial strategy has become more aggressive, and is potentially at odds with China’s economic policy. Being cut off from western markets, Putin is now proactive, while China which exports goods to them probably remains more cautious. But China knows that western capitalism bears the seeds of its own destruction, which would mean the end of the dollar and the other major fiat currencies. An economic policy based on exports to capitalistic nations would be a passing phase.

China’s gold policy was aways an insurance policy against a dollar collapse, realising that she must not be blamed for the west’s financial destruction by announcing a gold standard for the yen in advance of it. It would be a nuclear equivalent in a financial war, only an action to be taken as a last resort.

Developments in Russia have changed that. It is clear to the Russians, and most likely the Chinese, that credit inflation is now pushing the dollar into a currency crisis in the next year or two. Preparations to protect the rouble and the yuan from the final collapse of the dollar, long taught in Marxist universities as inevitable, must assume a new urgency. It would be logical to start with a new trade settlement currency as a testbed for national currencies in Asia, and for it to be set up in such a way that it would permit member states to adopt gold standards for their own currencies as well.

Possession of bullion is key

The move away from western fiat currencies to gold backed Asian currencies requires significant gold bullion ownership at the least. The only members, associates, and dialog partners of the Shanghai Cooperation Organisation and the EAEU whose central banks have not increased their gold reserves since the Lehman failure when the credit expansion of dollars began in earnest, are minor states. Since then, between them they have added 4,645 tonnes to their reserves, while all the other central banks account for only 781 tonnes of additional gold reserves.

But central bank reserves are only part of the story, with nations running other, often secret national bullion accounts not included in reserves. The appendix to this article shows why and how China almost certainly accumulated an undeclared quantity of bullion, likely to be in the region of 25,000 tonnes by 2002 and probably more since.

Since 2002, when the Shanghai Gold Exchange opened and China’s citizens were permitted for the first time to own gold, gold delivered into public hands has totalled a further amount of over 20,000 tonnes. While the bulk of this is jewellery and some has been returned to the SGE as scrap for re-refining, it is clear that the authorities have encouraged Chinese citizens to retain gold for themselves, which traditionally has been real money in China.

According to Simon Hunt of Simon Hunt Strategic Services, as well as declared reserves of 2,301 tonnes Russia also holds gold bullion in its Gosfund (the State Fund of Russia) bringing its holdings up to 12,000 tonnes. This is significantly greater than the 8,133 tonnes declared by the US Treasury, over which there are widespread doubts concerning the veracity of its true quantity.

Obviously, the Asian partnership has a very different view of gold from the American hegemon. Furthermore, in recent months evidence has confirmed what gold bugs have claimed all along, that the Bank for International Settlements and major bullion operators such as JPMorgan Chase have indulged in a price suppression scheme to discourage gold ownership and to divert bullion demand into synthetic unallocated accounts.

The secrecy that surrounds reporting of gold reserves to the IMF raises further suspicions over the true position. Furthermore, there are leases and swaps between central banks, the BIS, and bullion dealers that lead to double counting and bullion recorded as being in possession of governments and their central banks but being held by other parties.

As long ago as 2002 when the gold price was about $300 per ounce, Frank Veneroso, who as a noted analyst spent considerable time and effort identifying central bank swaps and leases, concluded that anything between 10,000 and 15,000 tonnes of government and central bank gold reserves were out on lease or swapped — that is up to almost half the total official global gold reserves at that time. His entire speech is available on the Gold Antitrust Action Committee website, but this is the introduction to his reasoning:

“Let's begin with an explanation of gold banking and gold derivatives.

“It is a simple, simple idea. Central banks have bars of gold in a vault. It's their own vault, it's the Bank of England's vault, it's the New York Fed's vault. It costs them money for insurance - it costs them money for storage--- and gold doesn't pay any interest. They earn interest on their bills of sovereigns, like US Treasury Bills. They would like to have a return as well on their barren gold, so they take the bars out of the vault and they lend them to a bullion bank. Now the bullion bank owes the central bank gold---physical gold---and pays interest on this loan of perhaps 1%. What do these bullion bankers do with this gold? Does it sit in their vault and cost them storage and insurance? No, they are not going to pay 1% for a gold loan from a central bank and then have a negative spread of 2% because of additional insurance and storage costs on their physical gold. They are intermediaries---they are in the business of making money on financial intermediation. So they take the physical gold and they sell it spot and get cash for it. They put that cash on deposit or purchase a Treasury Bill. Now they have a financial asset---not a real asset---on the asset side of their balance sheet that pays them interest---6% against that 1% interest cost on the gold loan to the central bank. What happened to that physical gold? Well, that physical gold was Central Bank bars, and it went to a refinery and that refinery refined it, upgraded it, and poured it into different kinds of bars like kilo bars that go to jewellery factories who then make jewellery out of it. That jewellery gets sold to individuals. That's where those physical bars have wound up---adorning the women of the world…

“We have gotten, albeit crude, estimates of gold borrowings from the official sector from probably more than 1/3 of all the bullion banks. We went to bullion dealers, and we asked, "Are these guys major bullion bankers, medium bullion bankers, or small-scale bullion bankers?" We classified them accordingly and from that we have extrapolated a total amount of gold lending from our sample. That exercise has pointed to exactly the same conclusion as all of our other evidence and inference---i.e., something like 10,000 to 15,000 tonnes of borrowed gold.”

Veneroso’s findings were stunning. But two decades later, we have no idea of the current position. The market has changed substantially since 2002, and today it is thought that swaps and leases are often by book entry, rather than physical delivery of bullion into markets. But the implications are clear: if Russia or China cared to declare their true position and made a move towards backing their currencies with gold or linking them to gold credibly, it would be catastrophic for the dollar and western fiat currencies generally. It would amount to a massive bear squeeze on the west’s longstanding gold versus fiat policy. And remember, gold is money, and the rest is credit, as John Pierpont Morgan said in 1912 in evidence to Congress. He was not stating his opinion, but a legal fact.

In a financial crisis, the accumulated manipulation of bullion markets since the 1970s is at significant risk of becoming unwound. The imbalance in bullion holdings between the Russian Chinese camp and the west would generate the equivalent of a financial nuclear event. This is why it is so important to understand that instead of being a longstop insurance policy against the Marxist prediction of capitalism’s ultimate failure, it appears that the combination of planning for a new trade currency for Asian nations centred on members of the EAEU, coinciding with the introduction of a new Moscow-based bullion standard, is now pre-empting financial developments in the west. That being the case, a financial nuclear bomb is close to being triggered.

* * *

Appendix

China’s gold policy.

China actually took its first deliberate step towards eventual domination of the gold market as long ago as June 1983, when regulations on the control of gold and silver were passed by the State Council. The following Articles extracted from the English translation set out the objectives very clearly:

Article 1. These Regulations are formulated to strengthen control over gold and silver, to guarantee the State's gold and silver requirements for its economic development and to outlaw gold and silver smuggling and speculation and profiteering activities.

Article 3. The State shall pursue a policy of unified control, monopoly purchase and distribution of gold and silver. The total income and expenditure of gold and silver of State organs, the armed forces, organizations, schools, State enterprises, institutions, and collective urban and rural economic organizations (hereinafter referred to as domestic units) shall be incorporated into the State plan for the receipt and expenditure of gold and silver.

Article 4. The People's Bank of China shall be the State organ responsible for the control of gold and silver in the People's Republic of China.

Article 5. All gold and silver held by domestic units, with the exception of raw materials, equipment, household utensils and mementos which the People's Bank of China has permitted to be kept, must be sold to the People's Bank of China. No gold and silver may be personally disposed of or kept without authorization.

Article 6. All gold and silver legally gained by individuals shall come under the protection of the State.

Article 8. All gold and silver purchases shall be transacted through the People's Bank of China. No unit or individual shall purchase gold and silver unless authorised or entrusted to do so by the People's Bank of China.

Article 12. All gold and silver sold by individuals must be sold to the People's Bank of China.

Article 25. No restriction shall be imposed on the amount of gold and silver brought into the People's Republic of China, but declaration and registration must be made to the Customs authorities of the People's Republic of China upon entry.

Article 26. Inspection and clearance by the People's Republic of China Customs of gold and silver taken or retaken abroad shall be made in accordance with the amount shown on the certificate issued by the People's Bank of China or the original declaration and registration form made on entry. All gold and silver without a covering certificate or in excess of the amount declared and registered upon entry shall not be allowed to be taken out of the country.

These articles make it clear that only the People’s Bank was authorised to acquire or sell gold on behalf of the state, without limitation, and that citizens owning or buying gold were not permitted to do so and must sell any gold in their possession to the People’s Bank.

Additionally, China has deliberately developed her gold mine production regardless of cost, becoming the largest producer by far in the world.[ii] State-owned refineries process this gold along with doré imported from elsewhere. Virtually none of this gold leaves China, so that the gold owned today between the state and individuals continues to accumulate.

The regulations quoted above formalised the State’s monopoly over all gold and silver which is exercised through the Peoples Bank, and they allow the free importation of gold and silver but keep exports under very tight control. The intent behind the regulations is not to establish or permit the free trade of gold and silver, but to control these commodities in the interest of the state.

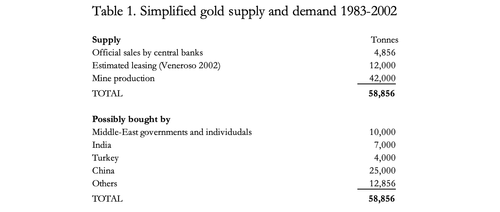

This being the case, the growth of Chinese gold imports recorded as deliveries to the public since 2002, when the Shanghai Gold Exchange was established and the public then permitted to buy gold, is only the more recent evidence of a deliberate act of policy embarked upon thirty-nine years ago. China had been accumulating gold for nineteen years before she allowed her own nationals to buy when private ownership was finally permitted. Furthermore, the bullion was freely available, because in seventeen of those years, gold was in a severe bear market fuelled by a combination of supply from central bank disposals, leasing, and increasing mine production, all of which I estimate totalled about 59,000 tonnes. The two largest buyers for all this gold for much of the time were private buyers in the Middle East and China’s government, with additional demand identified from India and Turkey. The breakdown from these sources and the likely demand are identified in the table below:

In another context, the cost of China’s 25,000 tonnes of gold equates to roughly 10% of her exports over the period, and the eighties and early nineties in particular also saw huge capital inflows when multinational corporations were building factories in China. However, the figure for China’s gold accumulation is at best informed speculation. But given the determination of the state to acquire gold expressed in the 1983 regulations and by its subsequent actions, it is clear China had deliberately accumulated a significant undeclared stockpile by 2002.

So far, China’s long-term plans for the acquisition of gold appear to have achieved some important objectives. To date, additional deliveries to the public through the SGE now total over 20,000 tonnes.

China’s motives

China’s motives for taking control of the gold bullion market have almost certainly evolved. The regulations of 1983 make sense as part of a forward-looking plan to ensure that some of the benefits of industrialisation would be accumulated as a risk-free national asset. This reasoning is similar to that of the Arab nations capitalising on the oil-price bonanza only ten years earlier, which led them to accumulate their hoard, mainly held in private as opposed to government hands, for the benefit of future generations. However, as time passed the world has changed substantially both economically and politically.

2002 was a significant year for China, when geopolitical considerations entered the picture. Not only did the People’s Bank establish the Shanghai Gold Exchange to facilitate deliveries to private investors, but this was the year the Shanghai Cooperation Organisation formally adopted its charter. This merger of security and economic interests with Russia has bound Russia and China together with a number of resource-rich Asian states into an economic bloc. When India, Iran, Mongolia, Afghanistan, and Pakistan join (as they now have or are already committed to do), the SCO will cover more than half the world’s population. And inevitably the SCO’s members are looking for an alternative trade settlement system to using the US dollar.

At some stage China with her SCO partner, Russia, might force the price of gold higher as part of their currency strategy. You can argue this from an economic point of view on the basis that possession of properly priced gold will give her a financial dominance over global trade at a time when we are trashing our fiat currencies, or more simply that there’s no point in owning an asset and suppressing its value for ever. From 2002 there evolved a geopolitical argument: both China and Russia having initially wanted to embrace American and Western European capitalism no longer sought to do so, seeing us as soft enemies instead. The Chinese public were then encouraged, even by public service advertising, to buy gold, helping to denude the west of her remaining bullion stocks and to provide market liquidity in China.

What is truly amazing is that the western economic and political establishment have dismissed the importance of gold and ignored all the warning signals. They do not seem to realise the power they have given China and Russia to create financial chaos as a consequence of gold price suppression. If they do so, which seems to be only a matter of time, then London’s fractional reserve system of unallocated gold accounts would simply collapse, leaving Shanghai as the only major physical market.

This is probably the final link in China’s long-standing gold strategy, and through it a planned domination of the global economy in partnership with Russia and the other SCO nations. But as noted above, recent events have brought this outcome forward.

No comments:

Post a Comment