Housing becomes even less affordable, and more people end up renting, and so rents go up,… until something breaks or is broken.

By Michael Every of Rabobank: US stocks decided to stage a hefty rally yesterday “because stocks”. That’s not that unusual for said market, but the excuse for why this happened was intellectually lazier than usual.

Apparently it was housing starts data that did the trick at 0.3% m/m rather than -1.6% expected. If so, we hardly have firm foundations for such optimism. First, it’s a volatile series. Second, builders reported soaring prices for the stuff needed to construct homes across the board. Third, starts of single-family homes --you know, the American dream-- were -1.7% m/m, while starts of multi-family units --you know, the American nightmare-- were up 7.5%. In short, fewer houses and far more luxury condos and low-end rental housing to squeeze all the people into who, despite living in a land with nothing but land, can no longer afford a home.

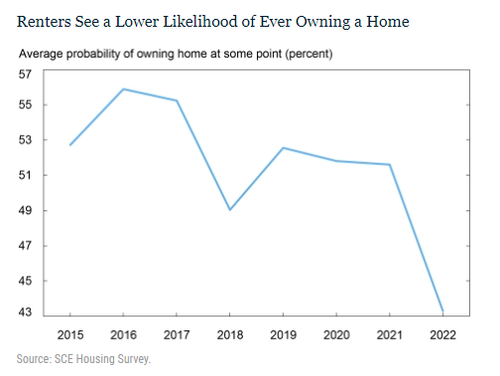

But these rental units will be owned by Wall Street. And it’s a one-way street, as The Hill reports “More Americans losing confidence they will ever own a home”: a NY Fed survey found only 43.4% of renters believe they’ll ever own a home, the first reading below 50% in the survey's history.

Yes, this is not 2008 sub-prime. But it is a dramatic structural shift with consequences that people with summer places in the Hamptons won’t grasp until it bites them – perhaps literally. We were promised Build Back Better post-Covid, not ‘Downton Abbey’ played out on a reverse timeline of socio-economic progress, as if it were directed by Benjamin Button. On which note, the 30,000 New York City doormen and building workers who keep high-price high-rises liveable just called off strike action after the Realty Advisory Board on Labour Relations agreed to cancel plans to trim their medical benefits, vacation days, and sick leave. (Because Wall Street is so short of cash, you see.) Contract terms will remain unchanged, and all involved will get 3% pay rises on average over the next four years. So only -5.5% in real terms so far this year. I thought rich people knew to always, always tip the doorman? Apparently not – or only after the threat of union action. But sleep soundly on your silk sheets and golden pillows, and under a rent-seeking blanket.

This backdrop will matter to the Street more than they can see. Most specifically, almost a third of the US CPI basket is tied to housing in the form of Owner Equivalent Rents (OER). Landlords are jacking up rents, because they can. As house prices become unaffordable, more people have to rent, and rents are what Wall Street wants them to be: after all, the alternative to the Street sweating you is the street. Yardi Matrix reports rents rose at double-digit rates in March. They also estimate by September this alone could add 0.7 percentage points to headline y/y US CPI. I can recall having similar discussions about the technicalities of OER back in the mid-2000s and how it would end very, very badly. Nobody wanted to listen.

This time round the optimism is that we have already seen peak inflation, yet “Peak inflation is the new transitory,” as our Philip Marey remarked to me yesterday. Indeed, US inflation will be rising due to OER at a time when the Fed already has an itchy trigger finger, which the upcoming Beige Book is likely to make even itchier. So, up go US rates. Then housing becomes even less affordable, and more people end up renting, and so rents go up,… until something breaks or is broken.

That could be in the US or in emerging markets, which might be one of the reasons why China did not cut the 1- and 5-year Loan Prime Rate from 3.7% and 4.6% again today despite narrow expectations for a 5bp reduction in both, and the ‘all hands on deck’ rhetoric from Beijing. Or it could be in the likes of USD/JPY, flirting with 130, with all that entails, as the BOJ again offers to buy unlimited 10-year JGBs with printed JPY to try to peg 10-year yields at 0.25%, against the backdrop of a commodity-driven trade deficit.

Of course, as US rents rise, down goes disposable household income for everything else in the economy for everyone who isn’t a rentier. Relatedly, the Street was also bullish yesterday due to real-time data showing US consumers are still spending and borrowing madly on their credit cards. With rents going up and prices soaring, it’s rational for consumer who can no longer afford groceries to rush to stock up before prices rise further,… but that is not a healthy sign for the economy! People who collect credit cards as status symbols do not grasp how the other far-more-than-half live. How many analysts making calls that suddenly-poorer people borrowing more is sustainably bullish have experienced that kind of life pressure themselves? I grew up around some who got paid monthly, many who got paid weekly and variably, and a fair few who relied on state benefits biweekly, and it is a mental framework that is still useful in a world where developed economies start to look more like emerging markets.

The EU is also seeing similar issues with house prices and rents. And, on top of those, Reuters reports an EU Russian oil embargo is really in the works: allegedly, this is set to be announced immediately after the results of the French election on Sunday – providing Macron wins, of course. Apparently, in a nudge-nudge, wink-wink kind of way, the measure is being held back until after that date to ensure that he does win.

One can try to estimate how high oil prices will rise as a result: $125? $135? $150? $165? The long and the short of it is you want to be long and not short oil. Yet this will mean a huge loss of household disposable income and a massive economic shock. What kind of sub-prime-style pressures could it unleash? Then again, what would the ECB’s pump sub-priming response be?

Meanwhile, on the Ukraine war, fighting is escalating in the east. Today’s recommended reading on the topic is meta, but worthwhile for that: Taleb’s “A Clash of Two Systems”, and Kamil Galeev’s epic on the true meaning of the letter ‘Z’, liturgy, vernacular, the printing press, poetry, Pushkin vs. Shevchenko, and where Huntingdon’s ‘Clash of Civilizations’ thesis is wrong. Neither of them argue that this war is going to be over soon, or that there is a quick deal to be done.

Neither does the headline ‘China hails strong Russia ties ‘no matter’ what, vows to safeguard common interests’, and its vice foreign minister stating:“No matter how the international situation evolves, China will, as always, strengthen strategic coordination with the Russian side to achieve win-win cooperation and jointly safeguard common interests,” while rising bilateral trade “fully demonstrates the great resilience … of the cooperation between the two countries.” His Russian counterpart replied Moscow treats China ties as a diplomatic priority and was willing to “further deepen the comprehensive strategic coordination and all-round practical cooperation… so as to safeguard international justice and equity.”

As such, it really would behoove the West to stop pump sub-priming and literally get its house(s) in order.

No comments:

Post a Comment