"There is no other better product that can be used to store value other than gold," says central bank official

“Following the successful

launch of the gold coins on 25 July 2022 and in response to public

demand, the bank shall introduce and release into the market gold coins

in units of a tenth ounce, quarter ounce and half an ounce

“Following the successful

launch of the gold coins on 25 July 2022 and in response to public

demand, the bank shall introduce and release into the market gold coins

in units of a tenth ounce, quarter ounce and half an ounce

for sale with effect from mid-November 2022,” Reserve Bank of Zimbabwe governor John Mangudya said this week.

The coins, which can be purchased from approved banks, were introduced to combat rampant inflation driven by locals exchanging Zimbabwean dollars for US dollars. In July, Zimbabwe's price inflation rate was over 250%.

The coins have "liquid asset status," according to the Zimbabwe central bank. That is, they're "capable of being easily converted to cash and [are] tradable locally and internationally...[and] may also be used for transactional purposes."

However, with one-ounce coins currently worth about $1,800, they're out of reach for typical citizens. The average civil servant in the country makes just $2,600 a year, according to the BBC.

The one-ounce coins are called "Mosi-oa-Tunya." That's the Tonga-language name for Victoria Falls, and translates to "The Smoke Which Thunders." When sold by banks, they're priced at the world price of gold plus a 5% minting and distribution fee.

When the coins were unveiled, Mangudya said:

“We are now providing that store of value to ensure that people do not run to the parallel market in search for foreign currency to store value. And there is no other better product that can be used to store value other than gold. We know what you have been going through in terms of the fear factor of losing value and therefore we are providing this gold coin."

Banks have sold 4,475 of the one-ounce coins so far, the state-affiliated Herald newspaper reports, with 90% having been purchased with local currency. Foreigners can only buy the coins with foreign money.

The proprietor of a Harare clothing shop told The Herald that black-market exchange rates have leveled out since the introduction of the coins. "For the past one or so weeks, the rates are stable and if it continues like this, we will be able to accept local currency and invest the profits in gold coins," Sharon Sangarwe said.

The black market for currency exists in part because Zimbabwe limits foreign exchange transactions. Effective this week, those restrictions are being liberalized, with the cap on individuals, micro, small and medium businesses changing from $500 a week to $5,000 a month.

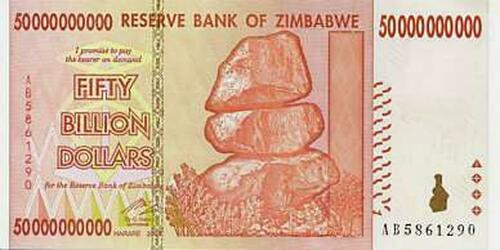

Zimbabwe's current sky-high inflation rate seems almost tame compared to earlier days. In 2009, the country's legendary hyperinflation prompted the central bank to issue astronomical denominations, such as this Z$50 billion bill -- which was only enough to buy two loaves of bread:

Zimbabwe has substantial gold deposits. "All gold mined in Zimbabwe is supposed to be sold to the central bank, but many producers prefer to smuggle it out of the country in order to get payment in US dollars," reports Al Jazeera.

No comments:

Post a Comment