"Everything is dirty. Nothing works. But everything’s also more expensive. And oh, by the way, you don’t have privacy anymore..."

Authored by Daniel Nuccio: That is how I described life in the US to a friend who had been living abroad for a bit more than a decade when we met up earlier this year during his brief return to the states.

We’re not a first world country anymore, I told him. Hopefully our decline stops somewhere around second world, I half-joked. That’s probably the best we can hope for.

Earlier that evening over dinner at what was once our regular spot, he told me of his life as a physician in Poland. I told him about my PhD work on the health effects of social isolation. He told me about the influx of young American soldiers into his current country of residence.

I described to him the dismal state of education back here at home. The lack of standards. The fetishization of boutique ideologies. The compulsory commitments to further favored political causes.

Now, after a mediocre movie intended for teenagers (or perhaps adults longing to be teenagers again) we meandered in the vacant parking lot of the Barnes & Noble we frequented when he’d return home from college, as well as in the years immediately following our undergraduate work when we were living at home, navigating our first few grownup jobs.

Standing under the sterile glow of aesthetically jarring LED lights, subtle symbols of our country’s progress, I told him about the drive through my hometown earlier that afternoon. The place where I’d grown up. The town where we both had attended high school.

For much of my life, it had seemed like a stereotypical suburb of the 90s, sort of akin to what you’d see in early episodes of The Simpsons. We were by no means Mayberry, but we were a largely clean, peaceful place populated by middle-class people going about their lives the best they could.

With time, yes, a plethora of mostly little changes occurred and accrued as they do everywhere. The video rental stores and comic book shops had closed long ago. The movie theater at which I watched Independence Day, Men In Black, and so many of the other major blockbusters of my childhood with my dad became a 24-hour gym.

The Toys R Us my parents or uncles would take me to for new video games and Nerf guns on random or special occasions was now an Indian grocery store. But for the most part, we retained many of the accoutrements of 90s suburbia well into the 2000s.

Yet, on the drive through that day, more stores just seemed abandoned. Everything appeared to have acquired a thin layer of grime I couldn’t recall being there in the Before Times or even on more recent trips home to visit family. There were also far more beggars than I had ever recalled seeing there at any time in the past.

At the risk of sounding pretentious, beggars and homeless people had always been a rare sight where I grew up. As a child, I thought of them as a largely exclusive feature of the city, seeing them only when my father would take our family Downtown for some excursion to a baseball game or the like, reprimanding my siblings and me if he ever caught us making some discourteous remark at their expense, echoing the admonitions of the teachers and priests at my parochial elementary school that homelessness could strike anyone at any time like some unfortunate disease. I also remember never quite believing them.

Something about the homeless populations I encountered on those rare occasions as a child always seemed indescribably but notably different. Sure, some of them could have been auto workers who lost good union jobs when their plant closed. Yeah, some may have been investment bankers who had fallen on hard times. But even then I could tell many of them seemed to be struggling with mental illness or addiction even if I failed to fully comprehend those concepts at the time.

Now though, in my hometown, that seemed to hold less true.

The lost souls stationed at practically every major intersection along the main road appeared in many cases exceptionally ordinary – and perhaps were until only a few years or even a couple of months earlier when…what? The bar they worked at was deemed unessential by government bureaucrats?

The restaurant they owned was forced to close because everyone was either too frightened by propaganda to eat out or didn’t wish to deal with all the multifarious government-mandated performative acts of obedience required by those simply seeking to sit down for a meal in public? They lost their low-level job as a municipal employee because they refused to take a medicine they didn’t want and in many cases likely didn’t need? Then again, maybe some still had a job but were struggling to keep up with the sudden spike in food prices?

Although I wouldn’t say I was struggling, I told my friend, it’s hard not to notice that my bag of broccoli and cauliflower seems to have a little more air than a year ago and my hummus container appears to take up a little less space in my fridge, while both items inexplicably now cost a dollar more. If someone was living paycheck-to-paycheck, especially if they had a family, it was difficult to imagine how they could keep up.

My friend reminded me this wasn’t just the US.

The price of basic food items like eggs had gone up considerably in Poland, he informed me. Having traveled more than I have in our current period of Reset and Reconstruction, he also told me how he’s noticed that sex-segregated restrooms were being phased out in a lot of places, circling back to our earlier discussion of the fetishization of boutique ideologies, albeit no longer relegated to university soil.

His saying this reminded me of how a colleague of mine reported something similar when traveling to New York earlier this year, describing the city as Gotham with gender-neutral bathrooms, zombified homeless people wandering the streets, and the constant smell of weed in the air.

Before parting ways for what would likely be another who knows how long, we went for a drive under the watchful eyes of the automatic license plate readers that sprouted up on practically every street light sometime between the Pandemic Period and our current Reset and Reconstruction phase – more undeniable signs of our country’s progress. We talked about the future. My friend was working through whether he wanted to stay in Poland, move to Canada where his then-girlfriend resided, or return to the US.

I told him I didn’t really know how things were in Poland, but at least the US wasn’t quite as explicitly totalitarian as Canada…yet. I also told him that I had come to acknowledge that pursuing a career as a professor and a scientific researcher long-term may no longer be an option for me given that I had spent the past two years publicly criticizing many of the political positions you’re required not only to profess but actively promote if you wish to teach at a university or do scientific research in the US.

Something else I thought about while we were driving around, or maybe sometime later as I left behind the area in which I had spent so many formative years was how so few people seem to notice so many of these changes – or casually accept them as normal if they do.

One particular example that sticks out to me now is something that occurred not long after my brief reunion with my expat friend. Once more I was driving down the main road in the town in which I grew up. Many stores still just seemed abandoned. Everything still appeared to possess a thin layer of grime. Beggars were still stationed at nearly every major intersection.

This time I was returning to visit my mother for a small dinner. On the way home, I stopped at a Starbucks not far from the Indian grocery store that used to be the Toys R Us where I got my first Mario Kart game as a kid and my first Resident Evil game as a middle-schooler.

Outside the Starbucks was an elderly woman, probably living on the streets, a little more reminiscent of my childhood notion of a homeless person than most of the seemingly newly-minted beggars at the intersections.

While I waited for my order, I overheard the baristas talking with a couple of customers about her. Apparently, she was always there, always troubled by demons no one else could see. Sometimes she came in and made a mess in one of the bathrooms. Sometimes she harassed customers in a way that went beyond just asking for a couple bucks or some change.

One of the customers with whom the baristas were speaking nodded along with the conversation, mentioning that she worked at a retirement home, authoritatively stating there was a full moon coming. From what she said, the old folks always get like this as the full moon approaches. The baristas nodded along in agreement.

Listening to this, I remember thinking we’re not a first world country anymore, but are we really a 1930s depiction of Nineteenth Century Romania? I knew we had accepted outrageous food prices and a steady population of beggars and homeless people in our suburbs as part of the New Normal, but I didn’t know we had accepted moon madness too.

Then again, maybe I was being overly pessimistic, overlooking obvious positives.

I

mean, for all I know, the bathroom in which this old homeless woman

suffering from moon madness regularly made a mess was gender-neutral, in

which case, if that’s not a sign of progress, I don’t know what is.

_____

Moody's Cuts USA's Aaa Rating Outlook To 'Negative'

...downside risks to the US' fiscal strength have increased and may no longer be fully offset by the sovereign's unique credit strengths.

Who could have seen that coming?

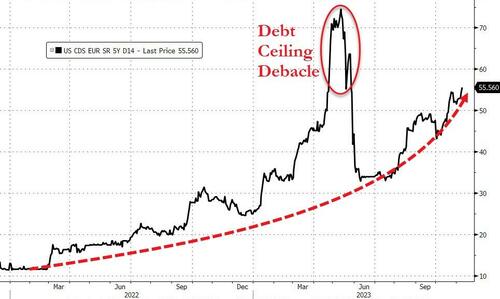

By Tyler Durden: After a disastrous 30Y bond auction this week, a collapse in Treasury market liquidity, and an accelerating rise in the market's perception of the United States' credit risk, Moody's has just cut its outlook on US credit ratings to negative from stable.

Source: Bloomberg

The key driver of the outlook change to negative is Moody's assessment that the downside risks to the US' fiscal strength have increased and may no longer be fully offset by the sovereign's unique credit strengths.

In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues, Moody's expects that the US' fiscal deficits will remain very large, significantly weakening debt affordability.

Continued political polarization within US Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability.

Moody's does affirm the Aaa rating:

The affirmation of the Aaa ratings reflects Moody's view that the US' formidable credit strengths continue to preserve the sovereign's credit profile.

First, Moody's expects the US to retain its exceptional economic strength. Further positive growth surprises over the medium term could at least slow the deterioration in debt affordability.

Second, the US' institutional and governance strength is also very high, supported in particular by monetary and macroeconomic policy effectiveness. While the adjustment of the US economy and financial sector to higher-for-longer interest rates is underway, policymakers have facilitated the transition through transparent and effective policy.

Finally, the unique and central roles of the US dollar and Treasury bond market in the global financial system provide extraordinary funding capacity and significantly reduce the risk of a sudden spiraling of funding costs, which is particularly relevant in the context of high debt levels and weakening debt affordability.

The US' long-term local- and foreign-currency country ceilings remain unchanged at Aaa. The Aaa local-currency ceiling reflects a small government footprint in the economy, relatively predictable and reliable institutions, very low external imbalances and moderate political risks, all of which reduce the risks posed to non-government issuers by government actions or shocks that would commonly affect the government and the private sector. The foreign-currency ceiling at Aaa reflects the country's strong policy effectiveness and open capital account which reduce transfer and convertibility risks to minimal levels.

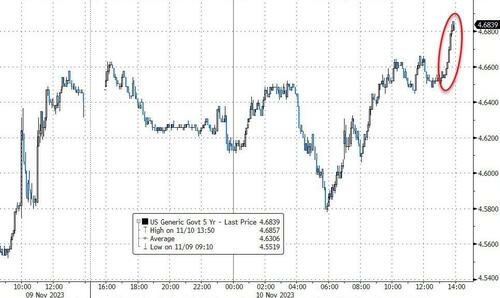

The market - late on a Friday - pushed yields on the 2Y and 5Y Treasyr notes to fresh new highs for the day...

Full Rationale for Outrlook cut:

ABSENT POLICY ACTION, FISCAL STRENGTH WILL DECLINE

The sharp rise in US Treasury bond yields this year has increased pre-existing pressure on US debt affordability. In the absence of policy action, Moody's expects the US' debt affordability to decline further, steadily and significantly, to very weak levels compared to other highly-rated sovereigns, which may offset the sovereign's credit strengths.

Past increases in interest rates by the Federal Reserve will continue to drive the US government's interest bill higher over the next few years. Meanwhile, although the government's revenue base will rise in line with the economy as a whole, in the absence of specific policy action, this will occur at a much slower pace than the rise in interest payments.

Moody's expects federal interest payments relative to revenue and GDP to rise to around 26% and 4.5% by 2033, respectively, from 9.7% and 1.9% in 2022. These projections factor in Moody's expectation of higher-for-longer interest rates, with the average annual 10-year Treasury yield peaking at around 4.5% in 2024 and ultimately settling at around 4% over the medium term. The debt affordability forecasts also take into account Moody's expectations that, absent significant policy changes, the federal government will continue to run wide fiscal deficits of around 6% of GDP near term and to around 8% by 2033, the widening being driven by higher interest payments and aging-related entitlement spending.By comparison, deficits averaged around 3.5% of GDP from 2015-2019. Such deficits will raise the US federal government's debt burden to around 120% of GDP by 2033 from 96% in 2022. In turn, a higher debt burden will inflate the interest bill.

For a reserve currency country like the US, debt affordability - more than the debt burden - determines fiscal strength. As a result, in the absence of measures that limit the size of fiscal deficits, fiscal strength will increasingly weigh on the US' credit profile.

FISCAL RISKS ARE EXACERBATED BY ENTRENCHED POLITICAL POLARIZATION UNDERSCORING RISING POLITICAL RISK

At a time of weakening fiscal strength, there is an increased risk that political divisions could further constrain the effectiveness of policymaking by preventing policy action that would slow the deterioration in debt affordability. These risks underscore rising political risk to the US' fiscal position and overall sovereign credit profile.

Recently, multiple events have illustrated the depth of political divisions in the US: renewed debt limit brinkmanship, the first ouster of a House Speaker in US history, prolonged inability of Congress to select a new House Speaker, and increased threats of another partial government shutdown due to Congress' inability to agree on budgetary appropriations. In Moody's view, such political polarization is likely to continue. As a result, building political consensus around a comprehensive, credible multi-year plan to arrest and reverse widening fiscal deficits through measures that would increase government revenue or reform entitlement spending appears extremely difficult.

While the US' Aaa rating takes into account relative weaknesses with regards to the quality of the country's legislative and executive institutions and fiscal policy effectiveness compared to other Aaa-rated sovereigns, there is a risk that these weaknesses take greater credit relevance because the deteriorating debt affordability trend would call for a more significant and effective fiscal policy response.

In particular, the US' lack of an institutional focus on medium-term fiscal planning, either through legislated fiscal rules aimed at improving the fiscal balance or general bipartisan consensus on the need for fiscal consolidation, is fundamentally different from what is seen in most other Aaa-rated peers such as in Government of Germany (Aaa stable) and Government of Canada (Aaa stable). Meanwhile, the more short-term focus of US fiscal policymaking, along with limited fiscal flexibility - because a very large portion of nondiscretionary budgetary spending is on mandatory entitlement programs and debt service (around 75% of total outlays), exacerbates already fractious bipartisan politics around a relatively disjointed and disruptive budget process. As annual debt service costs continue to rise, fiscal flexibility will diminish even further.

And cue Janet Yellen to dismiss this as folly...

Five minutes later, US Deputy Treasury Secretary Wally Adeyemo comments in emailed statement to Bloomberg:

“While the statement by Moody’s maintains the United States’ Aaa rating, we disagree with the shift to a negative outlook. The American economy remains strong, and Treasury securities are the world’s preeminent safe and liquid asset”

“The Biden administration has demonstrated its commitment to fiscal sustainability, including through the more than $1 trillion in deficit reduction included in the June debt-limit deal as well as President Biden’s budget proposals that would reduce the deficit by nearly $2.5 trillion over the next decade”

Still, not a great look as she "negotiates" with the Chinese.

No comments:

Post a Comment