By Michael Krieger: Obama needs to ensure he gets well compensated after leaving office for a job well done protecting, defending and further enriching the global oligarch class. This is precisely why he’s so adamant about passing the TPP during the upcoming lame duck session of Congress, when he knows “representatives” who no longer face reelection can be coerced or bribed into voting for this monumental public betrayal.

By Michael Krieger: Obama needs to ensure he gets well compensated after leaving office for a job well done protecting, defending and further enriching the global oligarch class. This is precisely why he’s so adamant about passing the TPP during the upcoming lame duck session of Congress, when he knows “representatives” who no longer face reelection can be coerced or bribed into voting for this monumental public betrayal.The Trans-Pacific Partnership (TPP) ins’t really a free trade deal, it’s a way for global oligarchs to consolidate, grow and protect their enormous wealth. The investor-state dispute settlement system (ISDS) is perhaps the most nefarious and objectionable aspect of the deal, with this shadowy court system being used to accomplish the following for the super rich and powerful:

1) Eliminate sovereign risk from their investments.

2) Earn money by scouring the world for potential ISDS “opportunities” and then speculating on them.

3) Escape prosecution from criminality on a global basis.

The whole thing is absolutely disgusting and epitomizes all that is wrong and unethical about the world today.

As such, stopping the TPP from passage is probably the most important near-term challenge ahead for all of us who want to make the world a better place (or at least prevent it from getting much, much worse).

Before getting into today’s article, I want to commend Chris Hamby and BuzzFeed for publishing this extremely timely and important work. We can only hope that it will inform millions of Americans sufficiently to create the needed pushback to prevent the TPP from ever becoming law.

So without further ado, let’s get on with it. What follows are excerpts from Part 1 of a four part investigative series. My snippets don’t do this work the justice it deserves; as such, I strongly encourage you to read the entire piece and share it with everyone you know.

Now, from the blockbuster piece, The Court That Rules the World:

Imagine a private, global super court that empowers corporations to bend countries to their will.I wonder why they failed. Perhaps the following will provide some insight: New Report from Princeton and Northwestern Proves It: The U.S. is an Oligarchy

Say a nation tries to prosecute a corrupt CEO or ban dangerous pollution. Imagine that a company could turn to this super court and sue the whole country for daring to interfere with its profits, demanding hundreds of millions or even billions of dollars as retribution.

Imagine that this court is so powerful that nations often must heed its rulings as if they came from their own supreme courts, with no meaningful way to appeal. That it operates unconstrained by precedent or any significant public oversight, often keeping its proceedings and sometimes even its decisions secret. That the people who decide its cases are largely elite Western corporate attorneys who have a vested interest in expanding the court’s authority because they profit from it directly, arguing cases one day and then sitting in judgment another. That some of them half-jokingly refer to themselves as “The Club” or “The Mafia.”

And imagine that the penalties this court has imposed have been so crushing — and its decisions so unpredictable — that some nations dare not risk a trial, responding to the mere threat of a lawsuit by offering vast concessions, such as rolling back their own laws or even wiping away the punishments of convicted criminals.

This system is already in place, operating behind closed doors in office buildings and conference rooms in cities around the world. Known as investor-state dispute settlement, or ISDS, it is written into a vast network of treaties that govern international trade and investment, including NAFTA and the Trans-Pacific Partnership, which Congress must soon decide whether to ratify.

The BuzzFeed News investigation explores four different aspects of ISDS. In coming days, it will show how the mere threat of an ISDS case can intimidate a nation into gutting its own laws, how some financial firms have transformed what was intended to be a system of justice into an engine of profit, and how America is surprisingly vulnerable to suits from foreign companies.

The series starts today with perhaps the least known and most jarring revelation: Companies and executives accused or even convicted of crimes have escaped punishment by turning to this special forum. Based on exclusive reporting from the Middle East, Central America, and Asia, BuzzFeed News has found the following:

When the US Congress votes on whether to give final approval to the sprawling Trans-Pacific Partnership, which President Barack Obama staunchly supports, it will be deciding on a massive expansion of ISDS. Donald Trump and Hillary Clinton oppose the overall treaty, but they have focused mainly on what they say would be the loss of American jobs. Clinton’s running mate, Tim Kaine, has voiced concern about ISDS in particular, and Sen. Elizabeth Warren has lambasted it. Last year, members of both houses of Congress tried to keep it out of the Pacific trade deal. They failed.

- A Dubai real estate mogul and former business partner of Donald Trump was sentenced to prison for collaborating on a deal that would swindle the Egyptian people out of millions of dollars — but then he turned to ISDS and got his prison sentence wiped away.

- In El Salvador, a court found that a factory had poisoned a village — including dozens of children — with lead, failing for years to take government-ordered steps to prevent the toxic metal from seeping out. But the factory owners’ lawyers used ISDS to help the company dodge a criminal conviction and the responsibility for cleaning up the area and providing needed medical care.

- Two financiers convicted of embezzling more than $300 million from an Indonesian bank used an ISDS finding to fend off Interpol, shield their assets, and effectively nullify their punishment.

ISDS is basically binding arbitration on a global scale, designed to settle disputes between countries and foreign companies that do business within their borders. Different treaties can mandate slightly different rules, but the system is broadly the same. When companies sue, their cases are usually heard in front of a tribunal of three arbitrators, often private attorneys. The business appoints one arbitrator and the country another, then both sides usually decide on the third together.

“It works,” said Charles Brower, a longtime ISDS arbitrator. “Like any system of law, there will be disappointments; you’re dealing with human systems. But this system fundamentally produces as good justice as the federal courts of the United States.”

I mean, it takes some nerve to make a statement like that.

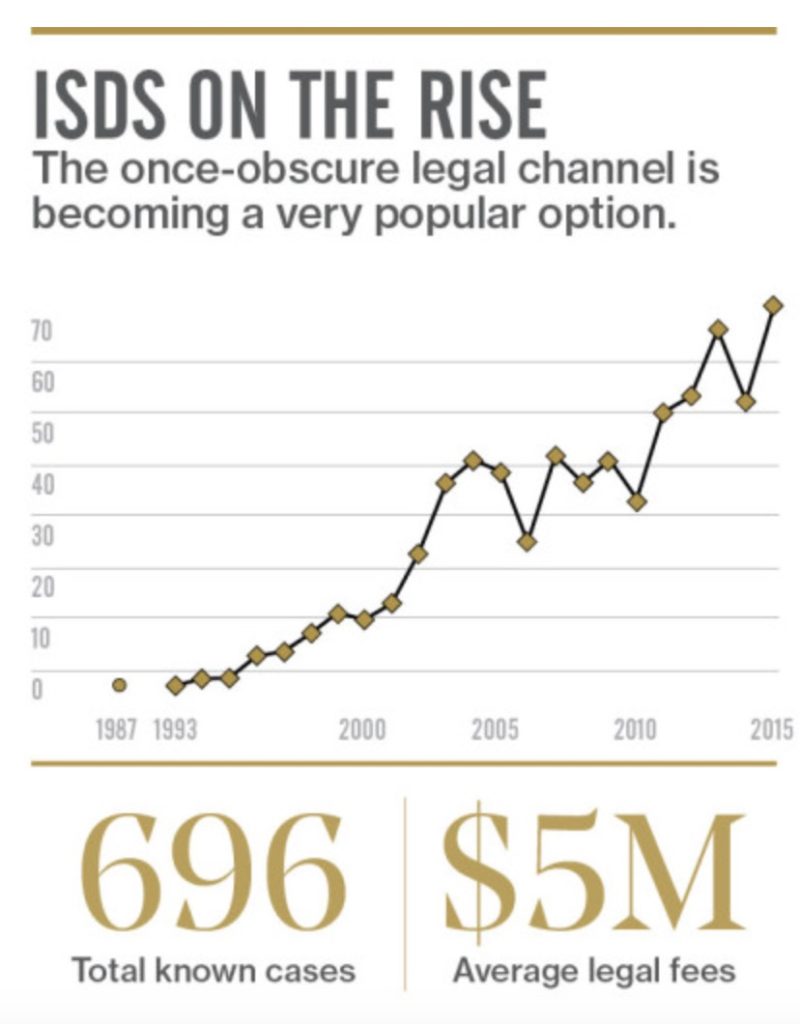

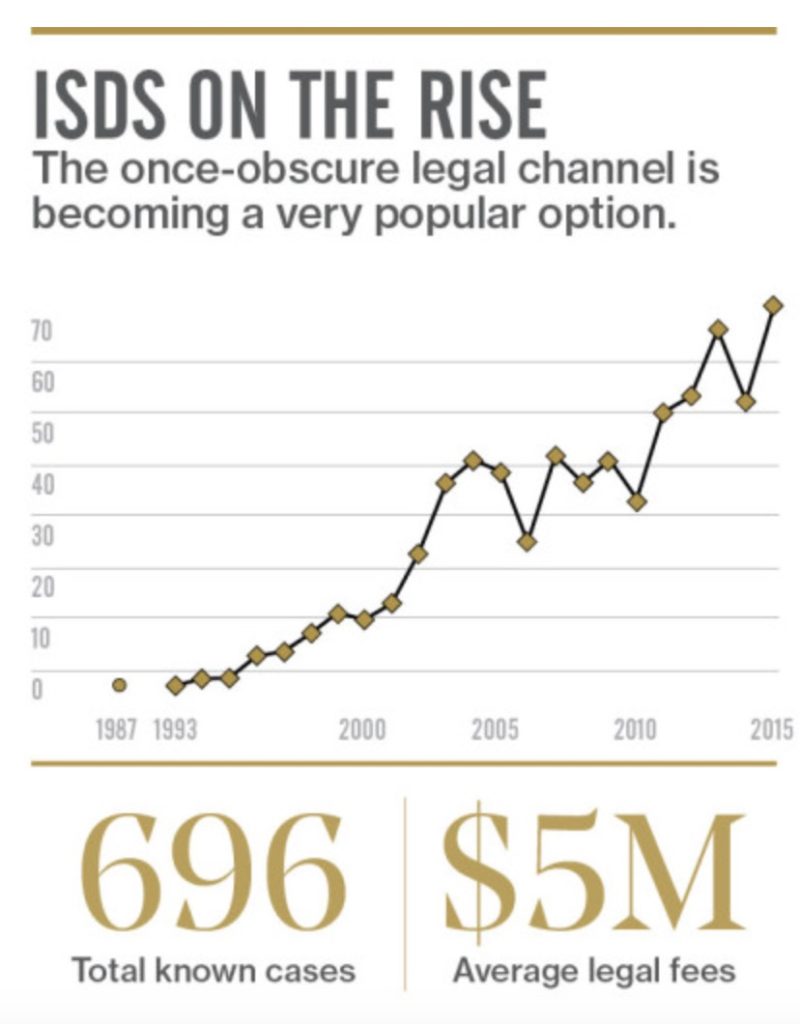

But over the last two decades, ISDS has morphed from a rarely used last resort, designed for egregious cases of state theft or blatant discrimination, into a powerful tool that corporations brandish ever more frequently, often against broad public policies that they claim crimp profits.Bull market in oligarch thievery continues unabated:

Because the system is so secretive, it is not possible to know the total number of ISDS cases, but lawyers in the field say it is skyrocketing. Indeed, of the almost 700 publicly known cases across the last half century, more than a tenth were filed just last year.

Driving this expansion are the lawyers themselves. They have devised new and creative ways to deploy ISDS, and in the process bill millions to both the businesses and the governments they represent. At posh locales around the globe, members of The Club meet to swap strategies and drum up potential clients, some of which are household names, such as ExxonMobil or Eli Lilly, but many more of which are much lower profile. In specialty publications, the lawyers suggest novel ways to use ISDS as leverage against governments. It’s a sort of sophisticated, international version of the plaintiff’s attorney TV ad or billboard: Has your business been harmed by an increase in mining royalties in Mali? Our experienced team of lawyers may be able to help.Can you believe this? Outside of technology, pretty much all the big money being made these days is from purely parasitic, extractive activities.

In a little-noticed 2014 dissent, US Chief Justice John Roberts warned that ISDS arbitration panels hold the alarming power to review a nation’s laws and “effectively annul the authoritative acts of its legislature, executive, and judiciary.” ISDS arbitrators, he continued, “can meet literally anywhere in the world” and “sit in judgment” on a nation’s “sovereign acts.”

Some entrepreneurial lawyers scout for ways to make money from ISDS. Selvyn Seidel, an attorney who represented clients in ISDS suits, now runs a specialty firm, one that finds investors willing to fund promising suits for a cut of the eventual award. Some lawyers, he said, monitor governments around the world in search of proposed laws and regulations that might spark objections from foreign companies. “You know it’s coming down the road,” he said, “so, in that year before it’s actually changed, you can line up the right claimants and the right law firms to bring a number of cases.”

Opposition to ISDS is spreading across the political spectrum, with groups on the left and right attacking the system. Around the world, a growing number of countries are pushing for reforms or pulling out entirely. But most of the alarm has been focused on the potential use of ISDS by corporations to roll back public-interest laws, such as those banning the use of hazardous chemicals or raising the minimum wage. The system’s usefulness as a shield for the criminal and the corrupt has remained virtually unknown.This is why Obama will try to pass it when the fewest members of government can be held accountable.

Most of the 35-plus cases are still ongoing. But in at least eight of the cases, bringing an ISDS claim got results for the accused wrongdoers, including a multimillion-dollar award, a dropped criminal investigation, and dropped criminal charges. In another, the tribunal has directed the government to halt a criminal case while the arbitration is pending.Now here’s an example of ISDS abuse from Egypt.

One lawyer who regularly represents governments said he’s seen evidence of corporate criminality that he “couldn’t believe.” Speaking on the condition that he not be named because he’s currently handling ISDS cases, he said, “You have a lot of scuzzy sort-of thieves for whom this is a way to hit the jackpot.

But, though Mubarak was gone, he had left behind a gift for investors like Sajwani: one of the world’s largest networks of investment treaties — twice the size of the United States’ — that allowed foreign businesses to file ISDS claims against Egypt. Within a week of Sajwani’s conviction over the Red Sea deal, Damac invoked one of these treaties and sued Egypt before the international arbitration arm of the World Bank.Here’s an example from El Salvador.

This argument — that the government at the time gave its blessing, so the sweetheart deal couldn’t be criminal — became the template for other businesses facing similar accusations.

By filing an ISDS claim, Sajwani took his case out of the Egyptian court system and placed it in the hands of three private lawyers convening in Paris. For the arbitrator he was entitled to choose, Sajwani appointed a prominent American lawyer who had often represented businesses in ISDS cases. And to press his case, Sajwani hired some of the world’s best ISDS attorneys.

For Egypt, the potential losses were big and would come as the country struggled to revive its floundering economy.

It decided to settle.

But the key benefit for Sajwani, according to all three: In exchange for dropping his ISDS case, Egypt would wipe away his five-year prison sentence and close out the probes of the other deals. The man who had been convicted of collaborating on a deal that would bilk the Egyptian people out of millions of dollars was now free and clear.

“Damac, followed by multiple other cases filed, made them say, ‘You know what, no; there should be another way,’” said Girgis Abd el-Shahid, a lawyer who represents corporate clients and assisted with Sajwani’s arbitration claim. “I believe that, after Damac, Egypt learned its lesson.”

Virtually across the board, the government began trying to settle.

In one case, an Egyptian court had declared a foreign company’s purchase of a factory corrupt and nullified the deal, court records show. But after the company filed an ISDS claim, the government agreed to pay $54 million in a settlement — roughly twice the price the company had paid for the factory just a few years earlier, according to news reports and documents reviewed by BuzzFeed News. A lawyer for the company said that his client had not been found guilty of a crime and that the company had made “significant investments” in the factory after acquiring it.

In another case, a second Dubai developer was under investigation — until he threatened an ISDS claim, according to the Cairo lawyer Hani Sarie-Eldin, who has represented the company. Instead of a criminal trial, the government opted for a settlement, and the mogul’s company went forward with its project, Sarie-Eldin said.

Meanwhile, the government has changed its laws, stripping public-interest lawyers and average citizens of the right to file court challenges to dubious public contracts, such as the sale of public land to a developer like Sajwani.

Heba Khalil, a researcher at an Egyptian human rights organization, recently recalled the chaotic but hopeful days after the fall of Mubarak. “No one knew what Egypt would be like,” she said. “International investors were kind of scared that the kind of deals that they did with the Mubarak regime wouldn’t be possible anymore.”

Then came the ISDS claims. “I think the impact of international arbitration,” Khalil said, was that Egyptians “started knowing that, ‘Oops, if we try to expose corruption, then those investors will take us to court internationally, and we will lose the case. Which means we had better just shut up and let the wrongs of Mubarak continue the way they are.’”

Not long after the battery factory set up shop on the edge of Sitio del Niño in 1998, people began noticing clouds of ash floating over from their new neighbor, descending on fields where children played soccer and seeping into their homes at night. It burned people’s throats and sent them into coughing fits.

Eventually, people started connecting the ash with the persistent headaches, dizziness, extreme fatigue, and constant bone and joint pain that children in particular were suffering. In 2004, a committee of local citizens began petitioning leaders for help, writing the town’s mayor, national government ministries, and eventually even other nations’ embassies and international aid organizations. For years, their efforts came to naught.

Then lead started showing up at potentially dangerous levels in the blood of the town’s children. Testing in 2006 and 2007 found that dozens of children, some as young as 3, had been contaminated.

In the midst of the trial, the prosecution agreed to settle. Prosecutors declined to comment on the role ISDS played, but the settlement document lays out the terms. The company agreed to pay for a limited cleanup of only the factory site, far short of the much more expansive cleanup the government has said is needed, and to establish a medical clinic in the village, albeit one that would provide only basic care and be funded for only three years. The company would also pay for some of the costs associated with the prosecution and make small donations to the community. And it agreed to drop its threat and not pursue an ISDS case.

Ultimately, the court concluded that the factory had contaminated the village. But that same court acquitted the three lower-level managers, so, it reasoned, it had no choice but to exonerate the company, too.

A force that helped persuade the judges, said Girón, the company’s lawyer, was the ISDS threat and its potential to slam the government with huge compensatory damages.

The failure to hold the factory accountable is an open wound for the impoverished residents of Sitio del Niño — a village whose very name, “Place of the Child,” is now a cruel joke. For six years, their community has been designated an “environmental emergency” by the government, which has warned them not to eat anything grown in the town’s contaminated soil. But many of them have no other option.

When NAFTA, the North American Free Trade Agreement, took effect in 1994, some lawyers at top firms took notice of ISDS for the first time. One heralded “a new territory” where some pioneering attorneys had ventured and “prepared maps showing a vast continent beyond.” What they saw was the opportunity to expand and reshape ISDS to their benefit, and the previously dormant system changed forever.

“A whole industry grew up,” said Muthucumaraswamy Sornarajah, an international lawyer and ISDS arbitrator who argued that the system is now being misused. Large law firms, he said, see ISDS “as a lucrative area of practice, so what happens is they think up new ways of bringing cases before the arbitration tribunals.”

A key service offered by the ISDS legal industry goes by various euphemisms: “corporate structuring,” “re-domiciling,” “nationality planning.” Critics have a different term: “treaty shopping.” It amounts to helping businesses figure out which countries’ treaties afford the most leeway for bringing ISDS claims, then setting up a holding company there — sometimes little more than some space in an office building — from which to launch attacks.

ISDS lawyers also grow the market for their services by advocating for new treaties, and some of the most outspoken are beneficiaries of the revolving door between the US government and top law firms.

Now meet a particularly nefarious cretin, Daniel Price.

Daniel M. Price negotiated the section of NAFTA containing ISDS when he was a lawyer at the Office of the US Trade Representative. He later served as a top international trade official in the George W. Bush White House.

In between these government stints, he worked as a private lawyer helping clients in ISDS cases. Twice he used the treaty he himself had helped negotiate to help US-based businesses pursue claims against Mexico.

He founded and chaired the unit handling ISDS claims at Sidley Austin, a leading global law firm. Today, he promotes his services as an arbitrator and, along with a powerhouse team that includes other former government lawyers, sells international expertise on ISDS and related matters.

Price, who at first agreed to an interview but later stopped responding to messages, is only one of a number of private lawyers who have exerted outsize influence on American policy on ISDS.

Yes, America. This is your government.

Finally, companies can gain advantages by bringing an ISDS suit, even if they don’t expect to win the case. Krzysztof Pelc, an associate professor at McGill University, found that there has been a proliferation of frivolous cases primarily intended not to win compensation but rather to bully the government — and other nations that want to avoid a similar suit — into dropping public-interest regulations. These new cases, Pelc found, represent a fundamental transformation of ISDS: The system was designed to deal primarily with theft by autocrats, but, in the majority of cases today, businesses are suing democracies for enacting regulations.

Finally, here’s the third example of how ISDS allows powerful people convicted of crimes to escape justice.

The British financial guru Rafat Ali Rizvi had a big problem: In Indonesia, where he’d plied his trade, he and a business partner had been convicted of embezzling more than $300 million from one of the country’s banks. The government there had to bail out the bank — sparking enraged protests that police tried to quell with tear gas and water cannons — and Indonesian authorities were pursuing him and the money they said he’d stashed in accounts around the world.

Ensconced overseas, Rizvi was beyond the reach of the Indonesian authorities. But the conviction came with an Interpol “red notice,” meaning he risked extradition if he traveled abroad. Some of his bank accounts were frozen. And with this stain on his record, he was largely cut off from the world of global finance he’d played in for years.

Rizvi’s topflight criminal lawyer had threatened to sue Interpol if the agency didn’t delete the alert, but so far it hadn’t worked. What Rizvi needed was an entirely different type of lawyer. Someone like George Burn.

Burn had spent years representing businesses in corporate disputes, but, like many of his colleagues, he was drawn to ISDS as the system began to flourish in the 1990s. Now, he said, ISDS cases make up the majority of his work as a London-based partner at the U.S. firm Vinson & Elkins.

The strategy he crafted for Rizvi epitomizes the ingenuity of elite ISDS lawyers and the willingness of arbitrators — many of whom are also attorneys who argue ISDS cases — to expand their own authority. It is a stark example of how canny and audacious lawyers can work the system, crafting a win even when they technically lose. The only real losers: a nation of taxpayers.

As usual.

First, Burn needed to find a treaty that would apply to this case. His team discovered an obscure agreement among predominantly Islamic nations, including Indonesia, where the case was unfolding, and Saudi Arabia, where al-Warraq was a citizen. There was no record of anyone using that pact to file an ISDS claim before, but Burn audaciously forged ahead.

In fact, an official present at the creation of that treaty 30 years earlier told the tribunal that the agreement was not supposed to allow ISDS cases at all. The arbitrators waved off this objection as “irrelevant.”

The key argument that Burn planned to make was that the criminal trial in Jakarta had violated al-Warraq’s right to fair treatment as a foreign investor. This protection is now commonplace in investment treaties and trade deals, and it has become one of the most controversial aspects of ISDS.

Guaranteeing foreign businesses “fair and equitable treatment” sounds like common sense. But many treaties don’t say what exactly that means, so arbitrators have found that governments have acted unfairly even when they regulated the price of water or merely complied with European Union law. Critics argue that such judgments have transformed a system that was supposed to uphold the rule of law into one that places foreign businesses above the law, able to get out of obeying almost any statute or regulation, no matter how worthwhile, that cuts into profits.

Many scholars and activists say the “fair and equitable treatment” provision, which is included in the Trans-Pacific Partnership now being considered by Congress, is the most widely abused element of treaties containing ISDS. Numbers from the UN’s trade and development body show that arbitrators find violations of this controversial provision far more than any other.

As it happened, though, the treaty Burn had invoked didn’t include that clause. But the agreement did have another common and often controversial clause, which requires a government to treat foreign businesses covered under one treaty at least as well as businesses covered under any of its other treaties.

So Burn plucked the fair-treatment provision from another agreement and applied it to the Islamic nations pact. In effect, he constructed his own super-treaty.

And the ISDS arbitrators allowed it, giving themselves the authority to rule on the actual merits of the case.

Martha took that crucial finding and presented it to his former employer. He argued that, unless Interpol dropped its red alerts against Rizvi and al-Warraq, the international cops themselves would be violating international law. Interpol obliged, deleting the red notices.

“Unprecedented Concessions by Interpol,” trumpeted a press release put out on behalf of Martha’s firm. The international cops also had agreed to delete information about the two convicts from its files and to send letters to certain risk profiling and due diligence agencies, as well as the roughly 190 Interpol member countries, according to the release.

“As a result, Mr. Rizvi and Mr. Al-Warraq will be able to travel and conduct business without restriction,” the release boasted. “Such results have never been obtained before from INTERPOL.” Reached by BuzzFeed News, Martha at first agreed to an interview but didn’t respond to subsequent messages.

So gross.

Finally, if all that wasn’t enough for you, I suggest reading the following article written by David Dayen a few days ago titled: The Big Problem With The Trans-Pacific Partnership’s Super Court That We’re Not Talking About.

In Liberty,

Michael Krieger

Now the legal team is trying to use the ISDS decision to block Indonesia from seizing the men’s foreign bank accounts. Initially, Indonesian authorities had won a small victory when a Hong Kong court granted them access to a $4 million account. But that’s been put in doubt…If all of this enraged you as much as it did me, please share this post as widely as possible and consider sending a message to Chris (chris.hamby@buzzfeed.com) thanking him for his work. Also, do whatever you possibly can to push back against Obama’s plan to pass this monstrosity after the election.

Finally, if all that wasn’t enough for you, I suggest reading the following article written by David Dayen a few days ago titled: The Big Problem With The Trans-Pacific Partnership’s Super Court That We’re Not Talking About.

In Liberty,

Michael Krieger

No comments:

Post a Comment