'There are similar parallels between the situation in the

UK today and the 1970's "Winter of Discontent," when shortages and

higher prices led to consumer misery.'

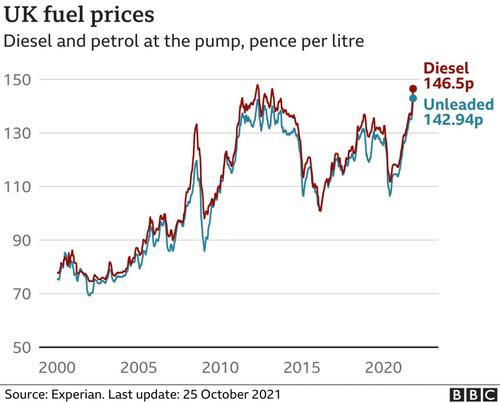

By Tyler Durden: UK petrol prices have risen to record-high levels in what RAC/Experian Catalist describes as a "truly dark day for drivers," according to Sky News.

Gas prices at the pump in Britain average 142.94 pence per liter on Sunday, surpassing the prior record, set in 2012, by .46 pence. Diesel prices hit 146.5 pence, just shy of the all-time high of 147.93 pence.

Fuel prices are more inflationary pressure on households and businesses, already dealing with rapid food inflation, elevated power prices, and the cost of living becoming more expensive, crushing real wages.

RAC fuel spokesman Simon Williams said: "This is truly a dark day for drivers, and one which we hoped we wouldn't see again after the high prices of April 2012. This will hurt many household budgets, and no doubt have knock-on implications for the wider economy:"

"The big question now is: where will it stop and what price will petrol hit? If oil gets to $100 a barrel, we could very easily see the average price climb to 150p a liter.

"Even though many people aren't driving quite as much as they have in the past due to the pandemic, drivers tell us they are more reliant on their cars now than they have been in years, and many simply don't have a choice but to drive.

"There's a risk those on lower incomes who have to drive to work will seriously struggle to find the extra money for the petrol they so badly need.

"We urge the government to help ease the burden at the pumps by temporarily reducing VAT, and for the biggest retailers to bring the amount they make on every liter of petrol back down to the level it was prior to the scamdemic."

Record high prices at the pump are unlikely to abate soon as Brent could hit $100 due to colder winter, some analysts and investment banks have said in recent months. Record-high natural gas prices are forcing some utilities to switch to oil derivatives instead, boosting demand for crude. Russian President Vladimir Putin recently said it's "quite possible" that Brent reaches $100 per barrel in light of the growing global demand for energy commodities.

AA fuel price spokesman Luke Bosdet said, "record pump prices must be saying to drivers with the means that it is time to make the switch to electric."

"As for poorer motorists, many of them now facing daily charges to drive in cities, there is no escape. It's a return to cutting back on other consumer spending, perhaps even heating or food, to keep the car that gets them to work on the road," Bosdet said.

And with the trucking situation and fuel shortage woes of last month solved, for now, gas and diesel prices seem likely to remain elevated for the coming months due to the simple reason that crude prices will stay high this winter due to robust demand from power plants.

There are similar parallels between the situation in the UK today and the 1970's "Winter of Discontent," when shortages and higher prices led to consumer misery. The question we have is if rapid inflation will lead to political change?

No comments:

Post a Comment