"I’m incredibly worried about the state of the economy, markets, and geopolitics..."

Authored by Peter Tchir: I’m incredibly worried about the state of the economy, markets, and geopolitics (please see Putin’s Speech SITREP).

With football season in full swing, maybe we will get a “bend but doesn’t break” type of market. Sentiment survey’s like AAII are sending some contrarian signals. That survey (which was published on Wednesday and presumably did not fully include the impact of the FOMC meeting) had bulls at a measly 17.7% and hit a yearly high of 60.9% of respondents being bearish. The CNN Fear & Greed index nudged back to extreme fear, but at a rating of 24, there is room for more fear (coincidentally, the index had the same reading this time last year before the S&P 500 rallied 10% into year-end).

Where To Start?

There are so many places to start and it is difficult to pick just one. We should probably start with FX since the moves there are starting to pit country against country, but we’ll start with rates because it is almost as important, just as broken, and more natural for us.

Rates

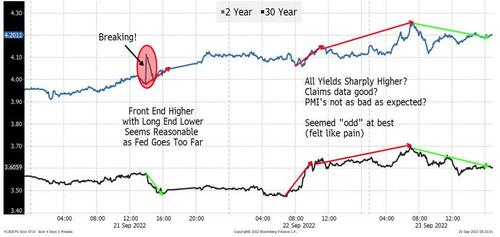

Once markets had time to digest Powell’s speech, there was a moment where rates reacted logically.

The front-end shot higher (with one ugly looking gap up and down), while the long-end rebounded. We’ve seen this reaction before. The Fed is going to hike more, so the front-end is forced to move higher, but the back-end gets nervous (rightfully so) that the hikes will put the brakes on the economy and ultimately we will have lower growth in the future.

On Wednesday, mortgage bonds outperformed as markets liked the Fed’s commitment not to sell MBS as part of quantitative tightening (How & Why The Fed Should Tweak QT).

But by Thursday, all hell had started to break loose in the bond markets. Every bond yield (across the globe) was shooting higher. One theory was that Japan was selling Treasuries to fund their intervention. Maybe we should have even started with FX because interventions could become a common occurrence in the coming weeks. Whether Japan was selling bonds or not, it captured the market’s attention. It also served as a reminder that China has been reducing their holdings of U.S. Treasuries according to the latest TIC data (from $1.07 trillion at the start of the year, down to $0.97 trillion as of the end of July). Investors are forced to wait until the middle of October to figure out what China did in August (nothing like real-time data). With tensions between the U.S. and China remaining elevated and obvious problems in the Chinese economy, it seems reasonable to expect this trend to continue.

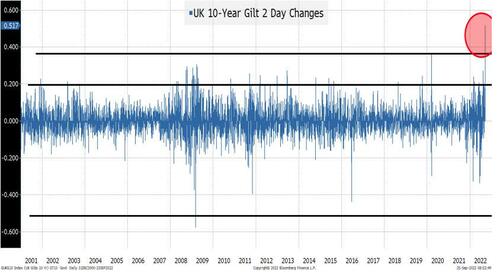

The real problem, though, for global bond markets was the UK and their Gilts!

The 10-year Gilt finished the week up almost 70 bps! (3.14% to 3.83%). The 2-day move, on Thursday and Friday, was 51 bps! To put that in perspective, the only time the 10-year Gilt had a bigger 2-day move was in March of 2009 when yields dropped by 58 bps. The recent move was bigger than moves that occurred during the dot.com bust, almost the entire Great Financial Crisis, the European Debt Crisis, Brexit, and Covid! Just a shockingly large move that dragged global bond markets with it.

This little statement from the September 2021 FOMC Statement is worth re-visiting.

If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

At the time, the U.S. was still buying $80 billion a month of Treasuries and $40 billion of MBS. Apparently, we no longer need to worry about “smooth market functioning” which I guess is good, because we don’t have smoothly functioning bond markets. Central bankers should re-visit quantitative easing and treat it like a nuclear weapon (rather than a pea shooter).

But we digress.

Volatility

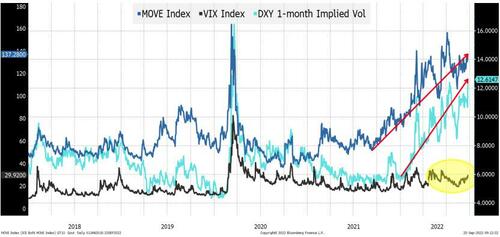

One outlier in recent moves is the VIX.

The MOVE index, a measure of Treasury market volatility, is high and is climbing again towards Covid levels. The implied volatility on DXY (a dollar index) is rising and is the highest it has been since Covid. Yet, for all that, the VIX remains subdued at just under 30. Is that a sign of health in equities, that investors are behaving calmly, or a sign that we haven’t seen capitulation yet?

Train Wreck Waiting to Happen?

With the VIX not at levels that reflect extreme fear, the behavior of “risky” ETFs continues to be intriguing.

TQQQ had over $250 million of in-flows on Friday and probably around $1 billion since September 13th. Not “bad” for a fund that is down 34% for the past month and 74% for the year. The fact that investors are still piling into triple leveraged ETFs as so many individual stock charts seem to be breaking down is either courageous or a recipe for disaster. ARKK had more muted inflows, while SQQQ saw profit taking.

Bitcoin keeps managing to claw back to about $19,000. Given what is going on with stocks, commodities, and bond yields, that is impressive. Though, with FX markets experiencing volatility and considering the interventions, the case to own something other than “fiat currency” does seem more credible. I’m still betting that we break $10,000 before the year is done in crypto.

FX

The Chinese Yuan is well above 7 and continues to weaken reflecting their economic problems.

The Euro is well below 1 (closing at 96.9) as the populace braces for power rationing.

The Pound is collapsing and was 1.35 at the start of the year and was 1.09 on Friday. Hearing lots of chatter about possible intervention, which is par for the course when it is easier to play with markets than question potential policy mistakes (like massive tax breaks).

The Yen is no longer a “safe haven”. The intervention may have slowed down the decline, but so long as the Bank of Japan remains on easy street while other central banks are hiking, those attempts are likely to be futile (at least until positioning against the Yen becomes too one-sided).

I think that the relative strength of the Mexican peso (compared to so many other currencies versus the dollar) is interesting and is indicative of a shift away from China (and Asia Pacific) to Mexico and Latin America for investors and companies. Central bankers who seemed to “get the joke” this time around also helped on a relative basis. This plays into our longer-term theme on how businesses and the global economy will develop, but that theme will take years in a market that for the moment seems to be thinking in terms of days and even hours. Historically, companies (and markets) struggle with such large shifts in FX rates. Policies that make countries more or less competitive often take years to succeed (or fail). With FX moves occurring at this speed, we will likely see some cracks and exposures. It doesn’t bode well for earnings in dollars.

Commodities

WTI is up 8.8% from November 2021 and is lower than at any time since January 2022. Gasoline prices continue to decline and the futures contracts out the curve are even lower.

Remember when lumber prices were daily news? Where “clever” social media users would send around pictures of 2x4s as a symbol of wealth? Well, the front contract at 435 is back to where it was in early 2020 (down 74% from its 2021 high and down 70% from its 2022 high). It’s an illiquid and thinly traded market, but it felt like an appropriate time to mention it.

Gold continues to decline and is 20% off its high of the year and is back to early 2020 levels. Given that crypto seems to be hanging in there and is slightly off its lows, it is curious that gold keeps leaking. Geopolitical tensions are high which should help gold, but with central bankers giving investors “real yields”, maybe the “barbarous relic” is in trouble? Gold could be an interesting way to play the possible rise of India, which has been another main theme here at Academy, but that is a story for another day.

DBC, a commodity ETF, is down 10% on the month and off 12.5% in the past 3 months (while still up 16% year to date).

The market seems to be shifting rapidly from viewing lower commodity prices as a sign that inflation is waning to a sign that the recession may already be here!

Bottom Line

There is limited evidence that the Fed has “slammed” the brakes on the economy. We can go back to debating jobs – Establishment versus Household or the fact that in the last report the data from 2 months ago was ratcheted down significantly. We can also point out that consumer spending saw the prior month’s data revised lower and try to forget that with high inflation, spending the same isn’t that much of an achievement. We can ignore the roll over in home prices, the increase in auto loan delinquencies, and the difficulties in commercial real estate where higher yields create a greater urgency in ending the WFH trend. Heck, we can even pretend that sub-50 PMI prints are “good” as they did beat expectations (the Citi Economic Surprise Index is slightly positive indicating that data has been beating expectations, but I think that the trend of downward revisions offsets that).

Finally, the wealth effect must be a concern! This year in general (and the past few weeks) have given us nowhere to hide. So called 60/40 funds, a bellwether strategy for individuals, are down 17% to 23% depending on the mix/index. They’ve been trounced, down 10% or so in the past month. More sophisticated risk parity strategies have also struggled of late. Crypto has not been good for investors this year. The Nasdaq 100 is still above the lows, but I’m told that the charts for many individual stocks are precarious. ARKK, as representative of disruptive stocks, is near its lows. Wealth destruction has been immense and is ongoing.

A very good chartist, who has caught many of the large moves this year, is looking at 3,200 on the S&P on this down leg. That would be problematic.

Rates (particularly U.S. rates) seem far too high.

I don’t see the economic data being good enough to support the current assumptions on Fed hikes. Yes, there are some nice union contracts being signed and wage gains are being made, but overall, company after company seem to be leaning towards belt tightening rather than spending and the Fed’s message this past week will only accelerate that trend. Apparently, that is what the Fed wants, but this feels like a case of “be careful of what you wish for”.

Markets are plagued by the lack of liquidity, potential selling by foreigners and sovereigns, and the mixed policy signals (talking tough on inflation but handing out money to “fight” inflation seems to be the norm, which is confusing).

Equities seem too complacent.

Yields are at the highs of the year. FX volatility is real and problematic. VIX and some aggressive fund flows don’t signal capitulation. Yes, stocks are cheap compared to where they were a year ago, but are they cheap to where they were in 2019? Are they cheap given the global uncertainty and restrictive monetary policy? In a world where central banks are shrinking their balance sheets (QT), we will face headwinds as markets are forced to absorb what the central banks once owned. Is the market pricing in QT or Stagflation? With commodity prices declining, we may be at risk of underestimating the impact of QT. Finally, what about private equity? That was a major source of cash raising for companies who in turn spent that money. There must be some cracks there that will weigh on the economy and markets!

There is a lot of fear in the market. Sentiment is awful. Is the Fed put truly dead? Will every Fed speaker stay on point, or will some deliver the hope of a pivot especially if the data is weak?

Credit is about right.

Riskier credit (high yield and leveraged loans) is weak and testing or breaking to new lows.

Investment Grade, while wider, is holding in reasonably well (if you watch the CDS indices, don’t forget that the 20th was a roll day to a new index, which added about 10 bps, making last week’s performance misleading). The market remains open for new issue as well.

Be very small on risk, utilize options, and watch credit markets! Liquidity is awful. Narratives and correlations are shifting rapidly!

No comments:

Post a Comment