They are flying by the seat of their pants, guesstimating as they go, while pretending it’s all coming out of scientific economic models...

Authored by David Stockman: The Fed holds interest rates to be its primary control valve, with lower ones providing a stimulus to the GDP and higher ones a brake. Self-evidently, therefore, interest rates below the inflation level are a stimulus because they amount to economic subsidization of debt, and the spending or investment which results.

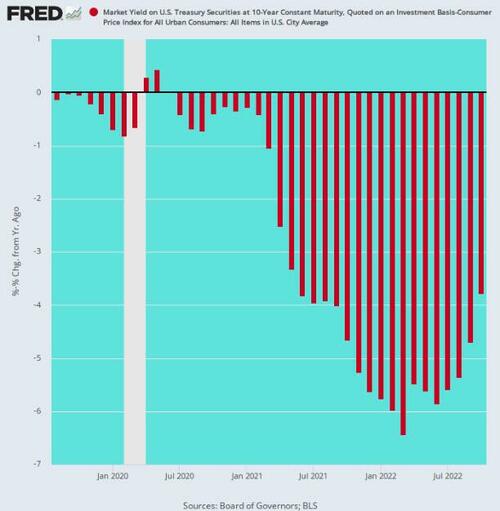

Still, even the primitive Phillips Curve theory of the growth/inflation trade-offs screams out that the Fed is way behind the curve, even based on its own defective economic models. After all, why in the world has it permitted its ultimate control valve and benchmark—the 10-year UST—to carry a negative real yield for 36 of the last 38 months.

That’s right. There is nothing like the pattern shown below in modern history, yet somehow the Keynesian dunderheads domiciled in the Eccles Building have been surprised at the virulence and persistence of the current inflationary tide.

Inflation-Adjusted Yield on 10-Year UST, August 2019 to October 2022

Indeed, they more or less begged for it. For instance, Lael Brainard is one of the leading so-called policy-thinkers on the Fed, but just 33 months ago in February 2020 she generated a Bloomberg headline which read, “Fed’s Brainard Calls for New Strategy to Boost Inflation” and included the following gems:

Federal Reserve Governor Lael Brainard on Friday called for the adoption of new strategies by the central bank to achieve its 2% inflation goal and fight off future recessions.

The Fed should seek above-target price gains to make up for past inflation shortfalls and should cap Treasury debt yields if it’s forced to lower short-term rates as far as they can go in a downturn, she said in a speech in New York.

“Today’s low-inflation, low interest-rate environment requires not only new recession-fighting tools but also a new strategy to address the persistent undershooting of the inflation target — and the risk to inflation expectations — well before a downturn,” she said.

To that end, monetary “policy may have to remain accommodative for a long time” to make up for past inflation shortfalls, she added.

Well, they kept it ultra-accommodative for a real long time, until March 2022 when year-on-year CPI was already rising by 8.6%. So barely six months later Brainard’s headline generating proclivity at Bloomberg had taken on an altogether different ring: “Fed’s Brainard Vows To Fight Inflation ‘As Long as It Takes’

"We are in this for as long as it takes to get inflation down,” Brainard said at a conference hosted by The Clearing House and Bank Policy Institute in New York.

“Monetary policy will need to be restrictive for some time to provide confidence that inflation is moving down to target.

The rapidity of the tightening cycle and its global nature, as well as the uncertainty around the pace at which the effects of tighter financial conditions are working their way through aggregate demand, create risks associated with over-tightening.”

At the same time, “it is important to avoid the risk of pulling back too soon,” she said.

In other words, she doesn’t have a clue as to whether the monetary central planners should be tightening or easing and by how much or for how long.

That is, Keynesian central banking has turned the American economy into a giant economic science experiment. They are flying by the seat of their pants, guesstimating as they go, while pretending it’s all coming out of scientific economic models.

The drunken sailor’s take on the US economy and inflation articulated by Lael Brainard reflects nothing more than the ever-changing groupthink of the Fed heads and their acolytes on Wall Street. It is based on the in-coming data from primitive government measures of inflation, employment, GDP and other macroeconomic series—all stuffed into an economic framework/model predicated on blatantly faulty macroeconomic theories.

Foremost among these is the claim that, left to its own devices, the free market economy has an inherent death wish embodied in a propensity for deflationary collapse. Accordingly, the central bank must be continuously vigilant to ensure that there is sufficient inflation to keep nominal GDP rising.

* * *

The truth is, we’re on the cusp of an economic crisis that could eclipse anything we’ve seen before. And most people won’t be prepared for what’s coming.

No comments:

Post a Comment