As the intellectuals scribble their excuses, public fury is on the rise.

Authored by Jeffrey A. Tucker: There’s something about employed intellectuals. When they are trashing popular wisdom and perceptions of regular people, they are truly in their element.

They love nothing better. It’s a way for them to show off their superior understanding, flash their credentials, and dazzle others with the merit of their time and expense in schooling. It justifies their social standing and income. And it assures their jobs.

Where would we be without them? Wallowing in ignorance, no doubt.

The trouble is that very often the popular wisdom is correct whereas the intellectuals are wrong.

We’ve seen many examples of this recently with regard to inflation. It seems that most people think it is getting worse and going in the wrong direction. A recent poll of swing-state voters shows that 74 percent of people say exactly this.

By wrong direction, plain English means: prices are not going down but rather still going up faster than one would desire.

In fact, the commodities markets seem to agree. Look at the record gold and Bitcoin prices. Even the Federal Reserve is worried.

But the Wall Street Journal’s (WSJ) Greg Ip explains that the notion that inflation is still bad and even worsening is “simply not true. I’m not stating an opinion. This isn’t something on which reasonable people can disagree. If hard economic data count for anything, we can say unambiguously that inflation has moved in the right direction in the past year.”

He goes on to explain that over 12 months, the pace at which inflation is worsening is getting worse at a slower pace than previously. This is what Ip calls moving in the right direction. You can tell yourself that as you put on less weight this month than last, but it would not be a good idea to confuse this with losing weight.

As for prices going down, Ip sniffly dismisses that idea: the price level “rarely goes down.”

Oh.

And if someone asks how your diet is going, you can do the same and tell them with absolute certainty that actually losing weight is out of the question.

Mr. Ip is certain that a move from 6 percent to 3 percent inflation is a fall, even though it is really only a slower pace of rising and therefore not really an improvement. He would see this if the numbers were different. What if inflation were running at 40 percent and then rising only 35 percent? Would Ip dare go to print with an article claiming that inflation is improving? Not likely.

Sorry but most people think that an improved and even repaired inflation would restore prices to their 2020 level. That’s not going to happen but that’s actually what most people would like. And I agree. My own sense is that many people are only coming around now to the realization that what happened to us has done permanent damage to purchasing power.

It’s not a good sign that the Biden administration seems to think that the solution is jawboning package sizing back up!

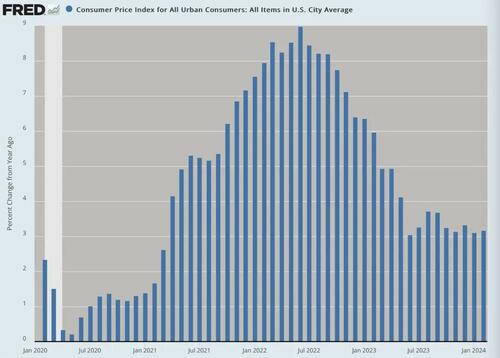

In any case, it’s not even necessarily true that the pace of increase is improving. The latest read of the official CPI (consumer price index) shows that it is going up higher than it did in June 2023. So even by that standard, the popular wisdom is more correct than the experts. By some measures, inflation is worsening at a faster pace.

Also, we are all a bit gun-shy. Who is to say that the next round of brutal inflation is not waiting just around the corner, in a repeat of the 1970s?

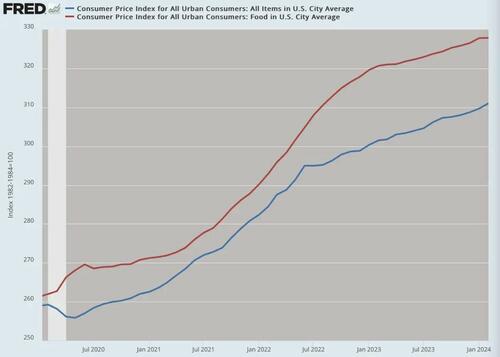

And have a look at food prices, up 35–50 percent since 2019 and still rising. It’s not even of this world to tut-tutting people for feeling that this much of an increase in 5 years amounts to getting worse.

Or just have a broad look at prices generally. No matter what the experts say, we are daily slammed with sticker shock. Remember that people do not buy all the products and services in the CPI daily. They encounter each price increase only in the course of their usual buying habits. It it has been nothing but bad news every time you take out your wallet.

When major journalistic venues come out and say “Oh it’s not that bad, so stop complaining,” it only discredits them.

In addition, Ip complains as follows: “By more than 2-to-1 (56 percent to 25 percent), respondents said the economy had gotten worse rather than gotten better over the past two years. That is difficult to square with robust employment growth, unemployment near its lowest in half a century, or growth in gross domestic product, which actually accelerated last year.”

Here again, the popular wisdom is smarter than the experts.

The jobs data has already experienced a major debunking. Full-time positions are giving way to part-time positions, mostly held by immigrant populations. This is a major factor as to why the establishment and household surveys have diverged so much over the last several years. The job market is not healthy. It is sick, with a continued lack of labor participation and worsening conditions for professional workers.

It’s not obvious from a superficial look at the data but it is clear from a deeper look.

Even the WSJ admits this in a separate piece: “the household employment figures haven’t just shown slowing job growth in recent months, but outright deterioration.”

Oh!

Another corrective comes from the Philadelphia Fed: “In the aggregate, 10,500 net new jobs were added during the period rather than the 1,121,500 jobs estimated by the sum of the states; the U.S. CES estimated net growth of 1,047,000 jobs for the period.”

By now, you surely also know that the GDP data cannot be trusted. It is ginned up by government debt and spending, without which the United States would likely already be in recession. This little tool of analysis was invented in the 1940s and heavily informed by bad economic theory but it somehow survives as a credible estimate of output. It absolutely is not.

Let’s return to inflation now.

It’s not just that rising prices are bad and eat into the standard of living. It’s also the case that the current CPI is wildly underestimated. Adding in the interest-based cost of borrowing puts last year’s inflation rate at 18 percent, which is far worse than we ever saw in the late 1970s. If we add to that the way inflation used to be calculated complete with a correct estimate of health-insurance costs, we are going further still. We could be looking at 20-plus percent on an annualized basis.

All the assurances we get from official economists that life is great achieve absolutely nothing in terms of convincing the public that what they are seeing all around them is not true. The instincts of the public are absolutely correct, contrary to the one thousand articles pouring out of the legacy media that say otherwise.

I’ve always enjoyed Greg Ip’s writing simply because he is a trained economist and speaks the language well. It’s sad (to me) to see his writing go the direction of becoming straight-up Biden administration propaganda.

Remember that line about how inflation was merely “transitional?” They are still saying that after three years.

Let’s face it: many such voices have disappointed us over these past few years, as many journalists and intellectuals have put career over integrity in their jobs.

We know this and see this every day. Still, it never stops disappointing me. Regardless, the public is not listening. Indeed, they have stopped reading, which is why the payrolls of mainstream venues keep shrinking more and more.

Meanwhile, as the intellectuals scribble their excuses, public fury is on the rise.

.jpg)

No comments:

Post a Comment