"This is yet another example of the US practice of coercive diplomacy by abusing state power and wielding technological hegemony"

Bloomberg first reported Washington's recommendation to Dutch chip equipment maker ASML Holding NV to halt selling some of its older deep ultraviolet lithography, or DUV, systems. Even though these machines are one generation behind cutting-edge, they can still make high-tech chips for automobiles and consumer electronics.

Responding to the Bloomberg report, Chinese Foreign Ministry spokesman Zhao Lijian criticized Washington on Wednesday for "technological terrorism" as both countries are locked in a chip race.

"This is yet another example of the US practice of coercive diplomacy by abusing state power and wielding technological hegemony. It is classic technological terrorism ... This will only remind all countries of the risks of technology dependence on the US and prompt them to become independent and self-reliant at a faster pace," Zhao told a regular news briefing Wednesday in Beijing.

If the Netherlands agrees, it will significantly increase the type of chipmaking equipment now prohibited for export to China.

Washington has also pressured Japan to stop shipping semiconductor machines to China.

Meanwhile, the writing was on the wall. Amir Anvarzadeh of Asymmetric Advisors said, "Chinese chipmakers have been hoarding second-hand equipment since the Trump era."

Anvarzadeh said banning the most advanced machines was "clearly not enough to halt China's advancement in semiconductors, especially since much of the chips used for defense purposes are using geometries that were far less advanced."

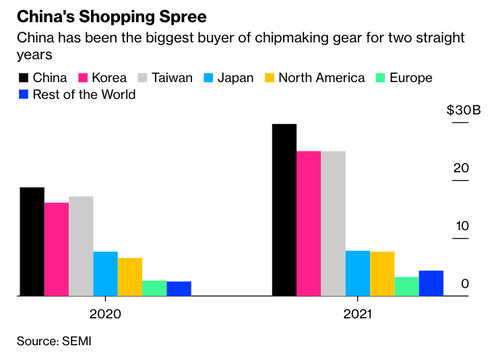

Since the Trump-era tariffs on consumer goods and export curbs on semiconductor chips and equipment for Chinese firms -- China has been the biggest buyer of chipmaking gear in the last two years.

The move by Trump to begin the curbs has been continued under the Biden administration, showing a much larger issue of America's survival and worry about China catching up in the chip race.

Wall Street analysts responding to the Bloomberg report say a complete ban preventing ASML from exporting semiconductor equipment, such as deep ultraviolet lithography systems, is unlikely. Here are the thoughts of several analysts (list courtesy of Bloomberg):

Evercore ISI analyst C.J. Muse (outperform) says the most likely outcome is continued restrictions on extreme ultraviolet lithography technology, but a full ban of ASML's DUV portfolio may not materialize

- Notes that ASML has paused shipments of its latest immersion tool NXT:2050i to China

- ASML and the Netherlands will push back on bans of tools that are readily available from competitors

- Thinks the Biden administration is looking to collaborate on a joint agreement with China

Citi analyst Atif Malik says more focused restrictions, such as curbing sales of US tech to SMIC, more likely than a broad-based ban

- Views a full chip equipment ban as more directly linked to potential foreign policy escalations

- Still, in a separate note, analyst Amit Harchandani (buy) says there could be more export control scrutiny around shipment to local Chinese chipmakers

Degroof analyst Michael Roeg (buy) says the discussion is not new, "yet it can easily scare investors"

- There should be no impact on ASML and other chip tool makers in the short term "as there is no ban, and perhaps it will not come at all"

- ASML could even see a short-term boost in demand as Chinese customers could be tempted to hoard DUV immersion equipment

Bloomberg Intelligence analysts Masahiro Wakasugi and Brian Moran say ASML's sales could fall by 5% to 10% if it's banned from selling deep ultraviolet tools in China

If ASML halts semiconductor equipment exports to China on behalf of Washington, the US must be prepared to accept the consequences.

No comments:

Post a Comment